Market Analysis By FXOpen

-

European Stock Markets on All-Time Roll Despite Economic Bleakness

There has been so much clamour over the past few months relating to the flagging European economy and stagnating British economy compared to the surprisingly healthy economic situation in the United States that it would be very easy to get buried in the deluge of news articles displaying woe which have been accompanied by a rising US Dollar against a declining Euro and Pound.

However, to write off the European economy as second fiddle to that of the United States purely on the grounds of a rising Dollar, some return to form for tech stocks and a relatively mediocre set of meeting notes from the Federal Open Market Committee, which reiterated the lack of a reduction in interest rates for the near future, would be churlish, to say the least.

On the European side of the Atlantic, a more thorough inspection of the overall market conditions would soon put the flagging Euro and mainstream media speculation of recession into perspective.

Over the past few weeks, European stocks have been increasing in value to the extent that some indices have registered an all-time high.

The CAC 40 index in France concluded the European session yesterday at 7,960.8 according to FXOpen charts, which is an all-time record high for the index, which comprises the 40 most highly capitalised stocks listed on French stock exchanges.

This all-time high has been achieved following a rally which began in mid-January, showing that investor confidence in this particular index is contrary to the overall pessimism surrounding the economic strength of the Eurozone compared to other regions of major commercial importance.

This morning, the French index began at a slightly lower value than yesterday's high, with 7,925.6 displayed by FXOpen charts at 9,00am UK time.

Overall, however, this is still a very high value compared to any period in the history of the exchange prior to the record-setting activity of the past week.

VIEW FULL ANALYSIS VISIT - FXOpen Blog...

Disclaimer: This article represents the opinion of the Companies operating under the FXOpen brand only (excluding FXOpen EU). It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

-

Market Analysis: Gold Price and Crude Oil Price Eye More Upsides

Gold price started a decent increase above the $2,028 resistance level. Crude oil prices are gaining bullish momentum and might rise toward $80.00.

Important Takeaways for Gold and Oil Prices Analysis Today

· Gold price started a decent increase from the $2,015 zone against the US Dollar.· A key contracting triangle is forming with support near $2,028 on the hourly chart of gold at FXOpen.

· Crude oil prices rallied above the $76.55 and $77.00 resistance levels.

· There is a key bullish trend line forming with support at $77.80 on the hourly chart of XTI/USD at FXOpen.

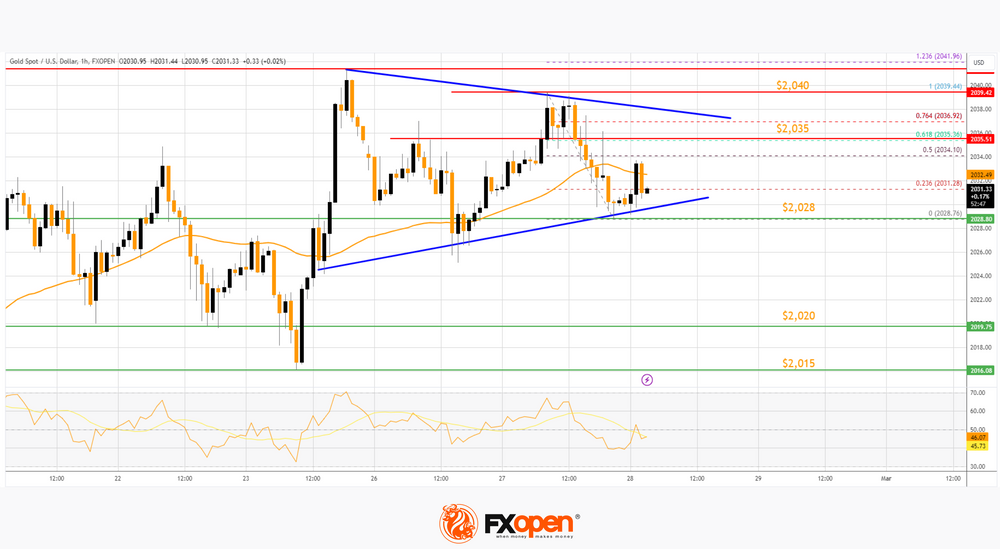

Gold Price Technical Analysis

On the hourly chart of Gold at FXOpen, the price found support near the $2,015 zone. The price formed a base and started a fresh increase above the $2,020 level.There was a decent move above the 50-hour simple moving average and $2,028. The bulls pushed the price above the $2,035 resistance zone. Finally, the bears appeared near $2,040, A high was formed near $2,039.44 and the price is now consolidating gains.

The recent low was formed at $2,028 and the price is now consolidating near the 23.6% Fib retracement level of the downward move from the $2,039 swing high to the $2,028 low.

The RSI is still stable near 40 and the price could aim for more gains. Immediate resistance is near the $2,035 level. It is close to the 61.8% Fib retracement level of the downward move from the $2,039 swing high to the $2,028 low.

The next major resistance is near the $2,040 level. An upside break above the $2,040 resistance could send Gold price toward $2,050. Any more gains may perhaps set the pace for an increase toward the $2,065 level.

Initial support on the downside is near the $2,028 zone. There is also a key contracting triangle forming with support near $2,028. If there is a downside break below the $2,028 support, the price might decline further. In the stated case, the price might drop toward the $2,015 support.

Oil Price Technical Analysis

On the hourly chart of WTI Crude Oil at FXOpen, the price started a major rally against the US Dollar. The price gained bullish momentum after it broke the $77.00 resistance.VIEW FULL ANALYSIS VISIT - FXOpen Blog...

Disclaimer: This article represents the opinion of the Companies operating under the FXOpen brand only (excluding FXOpen EU). It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

-

AAPL Share Price Rises Nearly 1% after Scrapping Electric Vehicle Plans

In 2021, the release of an electric car from Apple was expected in 2025, in 2022, the deadline was shifted to 2026. As it became known yesterday from Bloomberg and WSJ, Apple decided to completely abandon the project.

Causes for this decision:

→ the electric vehicle market turned out to be not so turbulent;

→ production and technological difficulties;

→ the strong development of electric vehicle construction in China may also have played a role.Some employees will be fired, others will be transferred to a more promising department related to developments in the field of AI. Despite the fact that the ambitious project, which lasted about 10 years, failed, the price of AAPL shares rose by almost 1% yesterday as a result of trading — perhaps investors positively assessed the reorientation from electric vehicles to a more promising direction related to AI.

The AAPL stock chart shows that the level of USD 180 per share acts as support; several rebounds from it have already been formed in 2024. And the news about the abandonment of plans to produce electric vehicles caused the last of them. However, how reasonable is it to buy AAPL shares in such a situation?

Issues for bulls may include:

→ the fact that the price of AAPL is significantly weaker than stock indices, which are rewriting historical peaks thanks to NVDA, MSFT and other leaders;

→ the results of reorientation from electric vehicles to AI are a long-term and uncertain prospect;

→ from the point of view of technical analysis of AAPL stock, a downward trend appears on the chart (shown in red). Its upper border is a potential resistance line. And if there is a bearish breakout of the important USD 180 support, it could further resist the bulls' attempts to restore the AAPL share price.Also causing negativity is that:

→ the price is fixed below the black trend line;

→ MACD is in bearish territory.VIEW FULL ANALYSIS VISIT - FXOpen Blog...

Disclaimer: This article represents the opinion of the Companies operating under the FXOpen brand only (excluding FXOpen EU). It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

-

Australian Dollar Weakens amid Inflation News

According to data published today by the Australian Bureau of Statistics, the Consumer Price Index (CPI) value was: actual 3.4%, expected = 3.6%, a month ago = 3.4%, 2 months ago = 4.3%.

Data shows Australia's consumer price growth rate is slowing, approaching targets of around 2%. This means less pressure on the Reserve Bank of Australia, which is pursuing tight monetary policy to combat inflation. Thus, the prospect of lower interest rates makes the Australian dollar weaker relative to other currencies.

For example, the reaction to news about inflation in Australia, which was below expectations, was the fall in the price of AUD/USD.

Technical analysis of the AUD/USD chart shows that:

→ the price of AUD/USD continues to develop in a downward channel (shown in red);

→ the price has broken through the important level 0.6535, which served as support since last week, but now, perhaps, will again begin to provide resistance, as it did in the first half of February;

→ in February, a bearish SHS pattern formed.Bulls can be given hope by:

→ psychological level 0.6500;

→ median line of the red channel;

→ important support 0.647.Please also note:

→ today at 16:30 GMT+3, US GDP data will be published;

→ tomorrow at 16:30 GMT+3, data on the US PCE inflation index will be published.Both news have the potential to have a strong impact on the US dollar exchange rate and related markets. Be prepared for spikes in volatility.

VIEW FULL ANALYSIS VISIT - FXOpen Blog...

Disclaimer: This article represents the opinion of the Companies operating under the FXOpen brand only (excluding FXOpen EU). It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

-

The American Currency Resumes Its Growth

The American currency, despite a rather multidirectional fundamental data, resumes growth at the end of February. In the main currency pairs, one can observe both rebounds from key levels and continuation of the main trends. Thus, the USD/CAD pair managed to strengthen above 1.3500, the GBP/USD pair lost about 100 pp after rebounding from 1.2700, and EUR/USD buyers failed to strengthen above 1.0900.

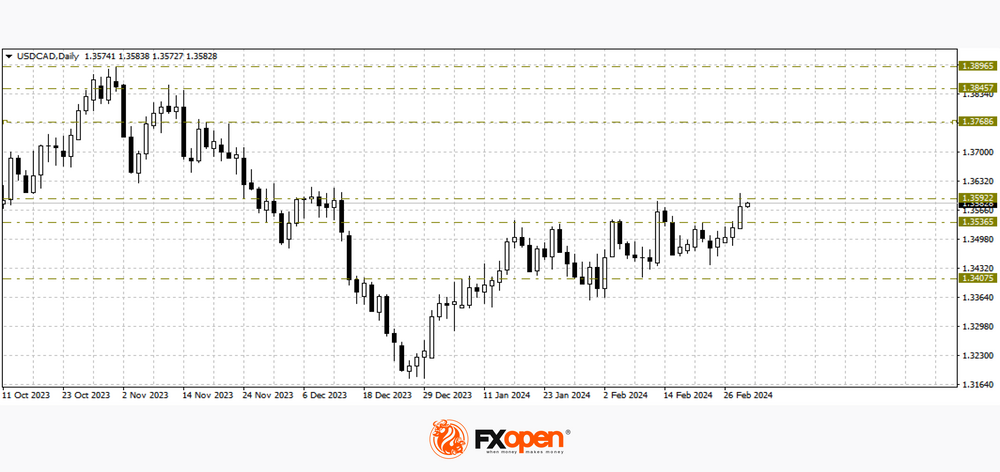

USD/CAD

Fluctuations in the oil market contributed to the strengthening of the USD/CAD pair. At the beginning of the week, sellers of the pair tried to break the support at 1.3400, but, as we see, were unsuccessful. Yesterday, the price on the USD/CAD chart not only strengthened above 1.3500, but also updated the current year’s maximum at 1.3580. If the pair's buyers do not lose their upward momentum, the price may strengthen to 1.3770-1.3700. The upward scenario may be cancelled by consolidation below the level of 1.3400.

Today, we can expect increased volatility in the pair. At 16:30 GMT+3, we are waiting for data on Canadian GDP for the fourth quarter of last year. At the same time, the basic price index of personal consumption expenditures in the US for January and indicators on applications for unemployment benefits for the current week will be published.

GBP/USD

At the end of last week, buyers of the British currency tried to break through the important resistance level at 1.2700. For about four trading sessions, the price on the GBP/USD chart was trading near this level, and yesterday it fell to 1.2620. If sellers of the pair manage to develop a downward movement, the pair may test the January lows of this year at 1.2530-1.2510.VIEW FULL ANALYSIS VISIT - FXOpen Blog...

Disclaimer: This article represents the opinion of the Companies operating under the FXOpen brand only (excluding FXOpen EU). It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

-

BTC/USD Price Exceeds $60,000 Per Coin

Several factors contributed to this:

→ Effect associated with the approval of Bitcoin ETF. The media writes that investments in these financial instruments amount to about 9k bitcoins per day, and miners produce only 900 bitcoins per day. The total investment in the Bitcoin ETF after approval on January 11 is approaching USD 50 billion. By comparison, just over USD 90 billion is invested in the 19 largest gold ETFs.

→ Expectations that Ethereum ETFs will be approved in the future, simplifying access to investments in the second largest cryptocurrency by capitalization.

→ Expectations for the Fed to cut interest rates. Cheaper credit means greater appetite for investment in higher-risk assets.

→ Expectations for the halving (scheduled for April), after which a bull market usually begins.

In mid-February, we wrote that the price of Bitcoin did not show bullish progress after exceeding the psychological level of USD 50k per Bitcoin. Technical analysis of the Bitcoin chart shows that this was due to resistance (shown by the arrow) from the median line of the green ascending channel, within which the market has been developing since the fall of 2023. Yesterday's rise, which followed the breakdown of the psychological level of 60k US dollars per bitcoin, marked the upper limit of this channel just above 64k US dollars per bitcoin and made it possible to update its contours.

Now the upper limit of the green channel acts as resistance, it is possible that after an increase of +25% in 2.5 days from point A to point B, buyers will want to take profits — this confirms the fact of yesterday's bearish impulse, in which the price of Bitcoin dropped from USD 64k to USD 59k.

So it is safe to assume that the market is ready for consolidation. But if the extremely optimistic growth rate shown by the blue lines continues, the price of Bitcoin could reach an all-time high of USD 67.7k as soon as spring arrives.

VIEW FULL ANALYSIS VISIT - FXOpen Blog...

Disclaimer: This article represents the opinion of the Companies operating under the FXOpen brand only (excluding FXOpen EU). It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

-

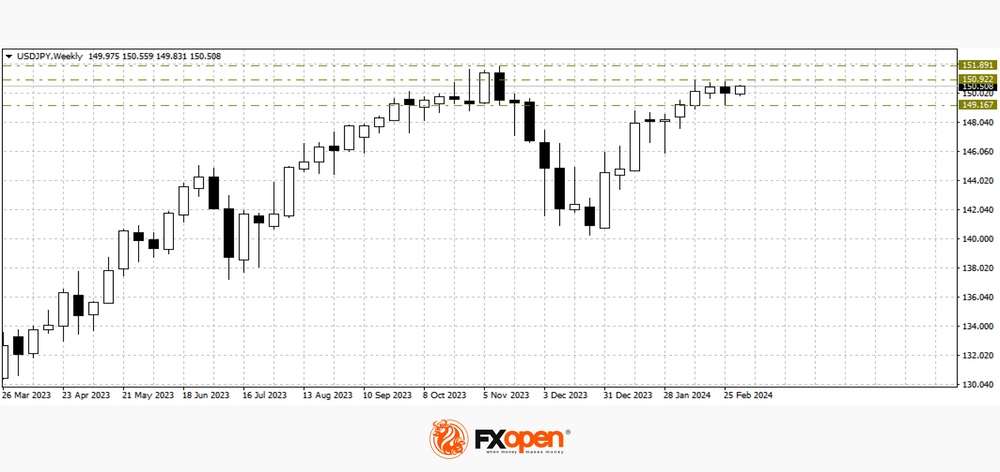

USD/JPY Technical Analysis: Yen Strengthens after Comments from Japanese Officials

This week has raised alarm bells for USD/JPY market participants who are trading the bullish momentum that has been going on since early 2024 (shown in the blue curved lines on the USD/JPY chart):

→ Vice Finance Minister Masato Kanda warned against “excessive volatility” in currency markets, hinting that the yen had weakened too much.

→ Bank of Japan board member Hajime Takata said that, in his opinion, there are prospects for achieving the inflation target of 2%, which opens the way to abandoning negative rates. Note that today there was news on inflation in Japan, which showed that it is slowing down. Thus, BOJ Core CPI in annual terms was 2.6%, a month ago = 2.6%, 2 months ago = 2.7%, 3 months ago = 3.0%.Statements from officials should increase the likelihood of a rate hike at the Bank of Japan's March meeting, thereby changing the prevailing sentiment.

Reuters writes that positions against the yen are at a record high, and their collapse could lead to the fact that the 2-month bullish trajectory of the USD/JPY price will be broken.

Wherein:

→ the psychological level factor of 150 yen per US dollar operates in the market — history shows that the fall of the yen below this level leads to a reaction from the Japanese financial authorities.

→ The USD/JPY price may fall to the support zone, which is formed by the level 148.50 (50% of the A→B impulse) and the level 148.8 (former resistance).VIEW FULL ANALYSIS VISIT - FXOpen Blog...

Disclaimer: This article represents the opinion of the Companies operating under the FXOpen brand only (excluding FXOpen EU). It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

-

Nasdaq-100 Price Hits All-time High after 4 Straight Months of Gains

The Nasdaq-100 index is holding above 18,000 today following yesterday's bullish momentum, fueled by inflation news.

The PCE consumer spending index amounted to 0.4% on a monthly basis, which was in line with analysts' expectations. A year ago, we recall, it was 0.6%. Thus, statistics indicate a weakening of inflation which means that the likelihood of the Fed cutting interest rates increases — the anticipation of this event increases optimism in the stock market.

Another driver is the strong price action of NVDA stock. The company's capitalization is close to USD 2 trillion, as Nvidia is perhaps the main beneficiary of the AI boom — NVDA's price rose approximately 28% in February.

The Nasdaq-100 chart shows that the index price has been in an upward trend since the beginning of 2024 (shown by the blue channel):

→ with the price is in its upper half;

→ from the point of view of technical analysis of the Nasdsaq-100, the level of 18k points, which acted as resistance in February, may support the market in March — however, this is if the bulls manage to gain a foothold above 18,000.In the meantime, the current exceeding of maximum 2 looks insignificant. And this creates the threat of a false bullish breakout — as an example, this turned out to be the maximum 2, when the price exceeded the maximum 1. Let's note another bearish factor, the overbought state on the RSI indicator.

VIEW FULL ANALYSIS VISIT - FXOpen Blog...

Disclaimer: This article represents the opinion of the Companies operating under the FXOpen brand only (excluding FXOpen EU). It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

-

Price of Gold Briefly Exceeded $2,050 per Ounce

In addition to new records in the stock markets, the reaction to yesterday's news about inflation in the US was also a decrease in government bond yields and a rapid rise in the price of gold — the cost of XAU/USD jumped by 0.9% in just one hour, while the day's high exceeded USD 2,050 per ounce .

However, on Friday morning the price of XAU/USD dropped below USD 2,040 – did market participants misjudge the impact of US inflation on the price of gold?

XAU/USD chart shows that:

→ the price of gold is in a downward trend (shown in red);

→ yesterday, the price not only touched the psychological level of USD 2,050, but also reached the upper limit of the downward red channel. That is, both lines acted as a block of resistance, which appears to be a serious obstacle to the upward impulse (shown by blue lines).A sharp change in sentiment (yesterday, positive, today, negative) may be similar to a sharp change in mood (in a mirror image) that happened in mid-February. As the blue arrows show, the negativity caused by the price falling below the psychological level of USD 2,000 within a few days was replaced by positive sentiment.

Therefore, it is possible that the activation of the bears, noticeable in the action of the price of gold this morning, may result in an attempt to resume the development of the market trend within the red channel. The nearest serious test of the seriousness of the bears' intentions may be the lower blue line, which worked as support in the second half of February.

VIEW FULL ANALYSIS VISIT - FXOpen Blog...

Disclaimer: This article represents the opinion of the Companies operating under the FXOpen brand only (excluding FXOpen EU). It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

-

WTI Oil Price Reaches 4-month High against the Backdrop of OPEC+ Decision

On Friday, the price of a barrel of WTI crude oil exceeded USD 80 per barrel due to the decision to continue the policy of reducing oil production by OPEC+ countries.

Saudi Arabia said on Sunday it would extend oil production cuts until June to “maintain stability and balance in oil markets,” an official statement said. Kuwait and the United Arab Emirates also said they would also continue cuts.

NYT writes that the decision was expected. At the same time, the price of WTI oil exceeded USD 80 per barrel on Friday for the first time since the beginning of November 2023.

The price chart for WTI oil shows that the market has been in an upward trend since mid-December - the price has formed an upward channel (shown in blue). In addition to the OPEC+ policy, the strength of demand is also supported by:

→ uncertainty in the military conflict between Hamas and Israel;

→ facts of attacks on oil tankers in the Red Sea.Will the price be able to consolidate at the peak reached? Arguments against the development of such a scenario are provided by a technical analysis of the WTI oil price chart:

→ the price is at the upper border of the ascending blue channel (that is, near the resistance line);

→ the USD 80 level can act as psychological resistance with the formation of a false breakout pattern;

→ the top formed on Friday is in the resistance area of the Fibonacci level of 50% of the decline A→B.VIEW FULL ANALYSIS VISIT - FXOpen Blog...

Disclaimer: This article represents the opinion of the Companies operating under the FXOpen brand only (excluding FXOpen EU). It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

-

5 Stocks To Consider in March 2024

Here we are, beginning the last month of the first quarter of 2024, which has passed by in somewhat of a flash.

Perhaps the apparent speed at which the spring is approaching can be attributed to what appears to be a single issue among analysts and market participants since the beginning of the year, that being the anticipation of announcements by central banks in Western countries with regard to monetary policy. Put simply, is the rate of interest going down?

Rather interestingly, it did not. The United States led the charge of announcements relating to monetary policy this year, and contrary to popular belief, the interest rates have not been reduced. The equities and commodities markets have had extra factors to consider, including logistical dire straits in the Red Sea, meaning products cannot reach their destination as freely as last year, and OPEC+ countries looking at production cut extensions in front of a backdrop of war in the Eastern Mediterranean region.

The markets have been somewhat volatile, which means trading activity remains interesting. Here are five interesting stocks to look at this month.

- eBay

Over the past few weeks, eBay stock has been demonstrating strong performance, with a continued overall upward direction since mid-January, with just a few blips on the way.

Last week, the e-commerce giant reported its earnings for the fourth quarter of 2023, which came to a remarkable $728 million, translating to $1.07 a share, compared with a net income figure of $671 million in the same quarter in 2022.

That led to a healthy increase in stock value. However, the real eye-catcher is what happened during the trading day on Thursday, February 28.

Suddenly, eBay stock rose from $44.32 on October 27 to $47.81 according to FXOpen charts, a considerable increase which continued to build, ending the trading day on Friday, March 1, at $47.97.

This sudden jump in value occurred a few days after the market's reaction to the positive results, and it is interesting indeed. eBay's high level of prominence in areas such as online advertising banner sales, fees from auction sales from private sellers, and premium listings from commercial sellers has led it to be the de facto marketplace for most of the world. Jumps like this are rare for such highly capitalised companies, so a keen eye will likely be on eBay's movements in the next few days.

- China Construction Bank (HK)

China Construction Bank is one of the largest banks in the world by market capitalization and is among the four largest banks in mainland China.

Its origins lie deeply rooted in state ownership, as is commonplace within the planned economy under which the People's Republic of China operates, and it was brought into being by the People's Bank of China, which is the Chinese central bank, beginning to spin off its commercial banking operations.

Considering its vastness and that it is such a vast corporation operating within the world's largest and most diversified economy, share prices within the Hong Kong-listed entity have been somewhat volatile recently.

During the course of the summer of last year, reports emerged stating that investors in the China Construction Bank (HK)'s stock had lost 13% over the past five years, clearly stating the long period of sustained losses, which are juxtaposition to the bank's massive might.

During the first few weeks of this year, China Construction Bank's Hong Kong-listed stock has been volatile, to say the least.

On January 3, the stock was trading at a low of $4.29HKD on FXOpen; however, by February 26, it had rallied to $4.95HKD before beginning to decrease again.

This is an inordinately low-value stock, which demonstrates the difference in tradability between Western banking giants and those with their origins in China. A leftfield one to look at, but interesting nonetheless.

- Coinbase

The endless news coverage about cryptocurrencies may have died down long ago, but the major digital asset exchanges are still very much alive and well.

Many of the large exchanges, such as Coinbase and Binance, got their product right in the design of intuitive trading applications, which attracted and retained a young, analytical audience. The euphoria that surrounded the cryptocurrency market in 2020 and 2021 may have ebbed away, but the extent to which many of the large exchanges went in order to provide proprietary apps that make sure they promote their brand in a way that ensures loyalty remains. Coinbase stock rocketed from $116.79 on February 5 to $208.35, according to FXOpen pricing on February 28.

That is a substantial increase in value and is without any mention of huge numbers of new crypto traders or meme boards creating their own markets, such as was the case 3 years ago.

- Lucid Group

Newly founded electric vehicle companies which have entered a somewhat conservative arena of car manufacturing often bask in the shadow of uber-disrupter Tesla, and many managed to make their way onto public stock exchanges via unorthodox SPAC listings rather than the hard slog that is years of heavy manufacturing and showing good balance sheets and economies of scale which is the way of the 140-year old motor industry's most recognised corporations. North America's Lucid Group is no exception. It is a relatively low-value stock and is a very well-established company; however, volatility has been the order of the day for some time now.

In mid-December last year, Lucid Group stock reached a sudden peak of $5.22 per share, according to FXOpen pricing, a value reached after a quick but short-lived rally. By January 19, it was down to $2.61 before heading back up to $3.50 on January 1. Since then, the share price has been erratic, to say the least.

Just two days ago, the company released its annual report, which was a damp squib. Earnings were 3.9% less than analyst estimates at US$595 million, and statutory losses were in line with analyst expectations at US$1.36 per share.

It seems there are those who believe in the new firms capitalizing on the electric vehicle revolution. However, it is hard to ignore the plethora of electric vehicles now on the market by some of the world's oldest and most established manufacturers, which are easily capable of ensuring that these new entrants could only ever be considered fringe players with an eccentric image.

- Rivian Automotive

In a rather similar vein to that of Lucid Group, electric truck manufacturer Rivian Automotive has been experiencing volatility; however, in the case of Rivian, it has been in a solid downward direction recently.

From a high point of $24.25 on December 19, Rivian stock has been plummeting, resting briefly at $15.37 on February 21 before crashing suddenly to $10.09 on February 26, according to FXOpen pricing.

VIEW FULL ANALYSIS VISIT - FXOpen Blog...

Disclaimer: This article represents the opinion of the Companies operating under the FXOpen brand only (excluding FXOpen EU). It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Modify message - eBay

-

Swiss Franc Weakens after Inflation News

Inflation in the country fell in February to its lowest level in nearly two-and-a-half years, data from Switzerland's Federal Statistical Office showed on Monday. Although consumer prices rose 1.2% compared to a year earlier, there is reason to believe that inflation is slowing down compared to the 1.3% recorded a month earlier.

Reuters writes that the Swiss National Bank has kept inflation rates within the target range since May 2023, despite rising rents, sales taxes and energy prices. And the latest news makes it more likely that the SNB will cut rates at its next meeting, scheduled for March 21.

Thus, market participants can expect a looser policy and an affordable franc — which is why the CHF has weakened against a number of currencies. For example, the EUR/CHF rate has reached its highest level since November 2023.

Wherein:

→ the price has broken through the downward channel (shown in red), which has been in effect since last summer — it seems that it is already losing relevance;

→ since the beginning of the year, the rate has already increased by more than 3.5%, which allows us to outline trend lines (shown in blue);

→ levels 0.94730 and 0.95580 changed their behaviour from resistance to support;

→ daily RSI indicates that after strong growth, the market is in the overbought zone, which creates the preconditions for the formation of a correction.If the growth continues, an important test of the seriousness of the bulls’ intentions may be the level of 0.96800 – near which important reversals in the EUR/CHF price were previously formed.

VIEW FULL ANALYSIS VISIT - FXOpen Blog...

Disclaimer: This article represents the opinion of the Companies operating under the FXOpen brand only (excluding FXOpen EU). It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

-

The Market Focusing on Speech of Federal Reserve Head

Despite the abundance of fundamental data of the past trading week, the main currency pairs continue to trade in rather narrow flat corridors. Thus, the US dollar/yen currency pair is trading above 150.00, from time to time testing the figure 149, buyers of the pound/US dollar pair do not give up trying to go above 1.2700, and the euro/US dollar pair has been trading between 1.0900-1.0800 for about three weeks. Apparently, investors are waiting for more specific signals from leading central banks to open new positions.

USD/JPY

Last week, greenback buyers in the USD/JPY pair once again tried to test important resistance at 151.00. The attempt was unsuccessful and ended with a sharp rollback to 149.10, which allowed the formation of a reversal pattern to begin on the weekly timeframe. If on the USD/JPY chart in the coming trading sessions the level of 151.00 remains in resistance status, the price may test 149.00 again. If buyers manage to gain a foothold above 151.00, growth may resume towards last year's highs at 151.90.Today at 17:45 GMT+3, we are waiting for the publication of data on the business activity index (PMI) in the services sector for February. A little later, the Purchasing Managers' Index for the US non-manufacturing sector from ISM will be published for the same period.

Tomorrow at 18:00 GMT+3, Fed Chairman Jerome Powell is scheduled to speak.

VIEW FULL ANALYSIS VISIT - FXOpen Blog...

Disclaimer: This article represents the opinion of the Companies operating under the FXOpen brand only (excluding FXOpen EU). It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

-

NASDAQ Rally Shows Tech Stocks Are Back in Focus - But for How Long?

The NASDAQ index, well known as a premier listing venue for North American technology companies across the entire spectrum from the Silicon Valley giants to recently listed newcomers, has been going from strength to strength during the beginning part of this year.

At the beginning of January, the NASDAQ was resting at a relatively low point in the mid-16,300 range and has since risen to 18,318.7 at the high points of the trading day in New York yesterday, according to FXOpen pricing.

This is a considerable increase, and apart from a few small dips along the way, it has been consistent for the majority of the first quarter of the year so far.

Yesterday's trading was of great interest to those with a keen penchant for US tech stocks, as the NASDAQ's high point of 18,318.7 represented an all-time record for the index, clearly demonstrating that these days, there is a clear distinction between enthusiasm among traders for NASDAQ-listed companies compared to two years ago when there was a sustained period of low value across NASDAQ listed stocks.

Those times are gone, and the halcyon days are back. However, the euphoria subsided slightly as the trading day came to a close yesterday during the US session, as the NASDAQ, despite a rallying group of technology stocks tied to the artificial intelligence boom keeping the values high, began to make a slight climbdown from its historic high.

Trading will begin today with the NASDAQ index standing at 18,129.1 according to the bottom of the candlestick on FXOpen charts, which is still high compared to the entire history of the NASDAQ index apart from the levels it reached during yesterday's trading.

Some of the contributors to NASDAQ's highs have been long-established computer technology giants which have been pioneering AI, an example being NVIDIA, a company traditionally synonymous with the manufacture of graphics cards, which had huge traction during the cryptocurrency mining boom last decade and sustained popularity among gamers around the world.

NVIDIA stock has boomed over the past month, with some sources quoting a 22.9% increase in stock value, therefore being a significant component within NASDAQ's listed giants, which is contributing to the index's recent resurgence.

As featured in the Top 5 Stocks for March 2024, Coinbase has been doing exceptionally well, a firm whose performance has also benefited the overall stature of the NASDAQ index within which it is a component.

VIEW FULL ANALYSIS VISIT - FXOpen Blog...

Disclaimer: This article represents the opinion of the Companies operating under the FXOpen brand only (excluding FXOpen EU). It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

-

Market Analysis: EUR/USD Eyes More Gains, USD/CHF Could Rally

EUR/USD started a fresh increase above the 1.0828 resistance. USD/CHF declined and now struggling below the 0.8860 resistance.

Important Takeaways for EUR/USD and USD/CHF Analysis Today

· The Euro rallied after it broke the 1.0828 resistance against the US Dollar.· There is a connecting bullish trend line forming with support near 1.0845 on the hourly chart of EUR/USD at FXOpen.

· USD/CHF declined below the 0.8860 and 0.8850 support levels.

· There is a key contracting triangle forming with resistance near 0.8850 on the hourly chart at FXOpen.

EUR/USD Technical Analysis

On the hourly chart of EUR/USD at FXOpen, the pair started a fresh increase from the 1.0800 zone. The Euro cleared the 1.0828 resistance to move into a bullish zone against the US Dollar, as mentioned in the previous analysis.

The bulls pushed the pair above the 50-hour simple moving average and 1.0855. Finally, the pair tested the 1.0875 resistance. A high was formed near 1.0876 and the pair is now consolidating gains. There was a move below the 23.6% Fib retracement level of the upward wave from the 1.0798 swing low to the 1.0876 high.

VIEW FULL ANALYSIS VISIT - FXOpen Blog...

Disclaimer: This article represents the opinion of the Companies operating under the FXOpen brand only (excluding FXOpen EU). It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

-

After Updating the Historical High, the Price of Bitcoin Collapsed by 14%

Bitcoin's previous all-time high price, recorded on November 10, 2021, was around USD 68,900 per coin (depending on exchanges).

But yesterday, the price of Bitcoin exceeded 69k! However, the jubilation from the new historical peak quickly gave way to fear — as the BTC/USD rate began to fall rapidly. From peak A to low B – the price traveled a path of more than -14% in just 5 hours.

These events highlight 2 characteristic features of the cryptocurrency market:

→ Excessive volatility, which is not typical for the stock and foreign exchange markets. For comparison: on October 19, 1987 — Black Monday — the S&P 500 index fell by about 20.5%. After this incident, there were no days when the drop exceeded 14%.

→ Emotionality of the market and the importance of psychological levels. At these levels, the price of Bitcoin often makes false punctures. Yesterday, there were 2 such punctures: a false bullish puncture of the 2021 top, and a false bearish puncture of the round level of 60k dollars for Bitcoin.

It is also worth noting that yesterday’s low was strengthened by support lines:

→ Fibo level 50% of the rally 0→A.

→ The lower border of the ascending channel (shown in blue).VIEW FULL ANALYSIS VISIT - FXOpen Blog...

Disclaimer: This article represents the opinion of the Companies operating under the FXOpen brand only (excluding FXOpen EU). It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Modify message -

TSLA Stock Price Falls Over 9% in Just 2 Days

The day before yesterday, trading in TSLA shares began at an opening price of USD 199.34; trading yesterday closed at a price of USD 180.51. The fall in TSLA shares led Musk to lose the title of the world's richest man to Jeff Bezos.

The main driver of the decline in the price of TSLA shares was news:

→ about the temporary shutdown of the Giga Berlin plant in Germany after an arson set by a group claiming that the company led by Elon Musk is devouring “land, resources, people”;

→ that deliveries of electric cars from the Shanghai plant have dropped to their lowest level in more than a year — which may indicate fierce competition with Chinese manufacturers.It also became known that Morgan Stanley analyst Adam Jonas is lowering his target price from USD 345 to USD 320 and predicting a decline in sales for FY24.

Technical analysis of the TSLA stock chart shows that:

→ The TSLA stock price is moving in a downward channel (shown in red), acting noticeably weaker than the broader market.

→ In March, the median line acted as resistance.

→ The price was unable to consolidate above the round level of USD 200 (in November last year it worked as support).VIEW FULL ANALYSIS VISIT - FXOpen Blog...

Disclaimer: This article represents the opinion of the Companies operating under the FXOpen brand only (excluding FXOpen EU). It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

-

The Price of Gold XAU/USD Sets a Historical Record Exceeding $2160 per Ounce

The previous high was around USD 2,135, but gold rose above USD 2,160 an ounce this morning, reaching its highest level ever, as Treasury yields weakened on hopes that the US Federal Reserve will soon begin cutting interest rates.

In a speech yesterday, the Fed chief offered no clarity, saying it would likely be appropriate to ease policy restrictions "at some point this year."

Traders now see a 70% chance of a Fed rate cut in June.

Technical analysis of the XAU/USD chart shows that:

→ the price of gold is in an ascending channel (shown in blue);

→ after a false breakout of its lower border, the price confidently overcame the downward trend line (shown in red) and resistance 2,090;

→ a strong upward impulse led to the RSI indicator entering the extreme overbought zone.Although the blue ascending channel leaves room for growth to its upper limit, the rise in the price of gold by more than 5% since the first days of March leaves the market vulnerable to a correction — for instance, to the median line of the ascending channel.

VIEW FULL ANALYSIS VISIT - FXOpen Blog...

Disclaimer: This article represents the opinion of the Companies operating under the FXOpen brand only (excluding FXOpen EU). It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

-

USD/CAD Analysis: Canadian Dollar Strengthens after Bank of Canada Decision

The Bank of Canada has decided to keep interest rates at 5.0% for the fifth time in a row, it announced yesterday, as it continues to look for clearer signs that inflation is moving closer to the bank's 2% target before considering rate cuts.

According to Bank of Canada Governor Tiff Macklem:

→ the Bank is concerned that underlying inflationary pressures remain.

→ It is too early to ease restrictive policies. There is a clear consensus within the Board of Governors that the time has not come (for rate cuts).

→ We are now in a difficult phase of the monetary cycle.These hawkish statements contributed to the Canadian dollar strengthening against other currencies, in particular against the US dollar.

Technical analysis of the USD/CAD chart today shows that:

→ for most of 2024, the price moves within the channel shown in blue;

→ yesterday’s news lowered the price from its upper limit to the median;

→ the psychological level of 1.36 retained its role as resistance, although the bulls repeatedly tried to overcome it.If the bears maintain the initiative, the price of USD/CAD may fall below:

→ breaking through the median line of the channel;

→ breaking through the local trend line (shown by the orange line);

→ attempting to break through the psychological level of 1.35.In this scenario, the most obvious target for bears may be the lower boundary of the channel, with news about inflation and interest rates remaining the main drivers in the USD/CAD market. Today, by the way, at 16:15 GMT+3, the decision on interest rates from the ECB will become known — be prepared for surges in volatility.

VIEW FULL ANALYSIS VISIT - FXOpen Blog...

Disclaimer: This article represents the opinion of the Companies operating under the FXOpen brand only (excluding FXOpen EU). It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

-

Market Analysis: AUD/USD and NZD/USD Start Fresh Rally

AUD/USD is gaining pace and recently cleared 0.6600. NZD/USD is also rising and could extend its increase above the 0.6200 resistance zone.

Important Takeaways for AUD/USD and NZD/USD Analysis Today

The Aussie Dollar is moving higher from the 0.6480 zone against the US Dollar.

A connecting bullish trend line is forming with support at 0.6615 on the hourly chart of AUD/USD at FXOpen.

NZD/USD is gaining pace above the 0.6155 support.

A key bullish trend line is forming with support at 0.6170 on the hourly chart of NZD/USD at FXOpen.

AUD/USD Technical Analysis

On the hourly chart of AUD/USD at FXOpen, the pair formed a base above 0.6480, as discussed in the previous analysis. The Aussie Dollar gained strong bids and started a decent increase above the 0.6540 resistance against the US Dollar.The bulls pushed the pair above the 0.6580 resistance zone. There was a close above the 0.6600 resistance and the 50-hour simple moving average. Finally, the pair tested the 0.6635 zone. A high is formed at 0.6633 and the pair is now consolidating above 23.6% Fib retracement level of the upward move from the 0.6477 swing low to the 0.6633 high.

VIEW FULL ANALYSIS VISIT - FXOpen Blog...

Disclaimer: This article represents the opinion of the Companies operating under the FXOpen brand only (excluding FXOpen EU). It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.