Market Analysis By FXOpen

-

NVDA Share Price Soars 11% after Report

The signs of concern we wrote about yesterday have largely subsided. After three days of declines, the price of E-mini Nasdaq 100 futures bounced off the lower boundary of the channel (see yesterday's chart) and rose, led by NVDA stock.

Nvidia's quarterly report exceeded expectations:

→ earnings per share: actual = USD 5.16, expected = USD 4.59;

→ gross revenue: actual = USD 22.10 billion, expected = USD 20.39 billion.According to the head of the company:

→ Accelerated computing and generative AI have reached a tipping point.

→ Demand for computing is growing worldwide among companies, industries and governments.

→ The coming year will bring major new product cycles with exceptional innovations that will help propel the industry forward.In post-market trading, NVDA's price rose 11% to over USD 740 per share. Thus, the price increase for NVDA since the beginning of 2024 is about 50%.

The NVDA stock chart shows that:

→ the USD 740 level acted as resistance in February;

→ however, taking into account the post-market price, we can assume that today at the opening of trading this resistance level will be broken and in the future, according to the logic of technical analysis, will begin to provide support;

→ in this case, a rebound will be formed from the lower line of the channel (shown in blue) and a wide bullish gap.VIEW FULL ANALYSIS VISIT - FXOpen Blog...

Disclaimer: This article represents the opinion of the Companies operating under the FXOpen brand only (excluding FXOpen EU). It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Modify message -

Commodity Currencies Strengthen after the FOMC Minutes Publication

The fundamental data of recent trading sessions contributed to a slight strengthening of commodity and European currencies. Thus, the AUD/USD pair, after forming a bullish engulfing combination, managed to confidently gain a foothold above 0.6500. The pound/US dollar currency pair retested the support at 1.2540 and went above 1.2600, and greenback sellers in the US dollar/loonie pair are trying to break the support at 1.3500.

GBP/USD

The price of the pound on the GBP/USD chart has been trading for the third week in a rather narrow range of 1.2680-1.2540. Apparently, to enter new positions, investors need a more important foundation than the publication of the FOMC protocols. The head of the Bank of England, Andrew Bailey, whose speech took place on Tuesday at 13:15 GMT+3, also failed to inspire market participants to make new entries.Today at 12:30 GMT+3, we are waiting for the publication of data on the business activity index in the UK services sector for February. At 17:45 GMT+3, the business activity index (PMI) in the US services sector for the same period will be released. Also at 18:00 GMT+3, data on sales on the secondary housing market for January will be published, and at the very beginning of the American session, weekly figures on the number of applications for unemployment benefits will be released.

USD/CAD

Sellers of the USD/CAD pair managed to close yesterday with a reversal combination to sell dark clouds. If we receive confirmation of this formation on the USD/CAD chart, we can expect a repeat approach to 1.3400-1.3370.Today at 16:30 GMT+3, we are waiting for the publication of the basic retail sales index in Canada for December. Also at 19:00 GMT+3, data on crude oil inventories in the United States for the last week will be released.

VIEW FULL ANALYSIS VISIT - FXOpen Blog...

Disclaimer: This article represents the opinion of the Companies operating under the FXOpen brand only (excluding FXOpen EU). It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

-

Market Analysis: AUD/USD and NZD/USD Grind Higher Steadily

TAUD/USD is moving higher and might rally if it clears 0.6600. NZD/USD is also rising and could extend its increase above the 0.6220 resistance zone.

Important Takeaways for AUD/USD and NZD/USD Analysis Today

· The Aussie Dollar is moving higher from the 0.6540 zone against the US Dollar.· There is a key bullish trend line forming with support at 0.6555 on the hourly chart of AUD/USD at FXOpen.

· NZD/USD is showing positive signs above the 0.6180 support.

· There is a major bullish trend line forming with support at 0.6190 on the hourly chart of NZD/USD at FXOpen.

AUD/USD Technical Analysis

On the hourly chart of AUD/USD at FXOpen, the pair remained stable near the 0.6500 zone, as discussed in the previous analysis. The Aussie Dollar formed a base and started a decent increase above the 0.6540 resistance against the US DollarThe bulls pushed the pair above the 0.6550 resistance zone. There was a close above the 0.6565 resistance and the 50-hour simple moving average.

The pair is now consolidating near the 50% Fib retracement level of the downward move from the 0.6595 swing high to the 0.6542 low. On the upside, the AUD/USD chart indicates that the pair is now facing resistance near 0.6575.

VIEW FULL ANALYSIS VISIT - FXOpen Blog...

Disclaimer: This article represents the opinion of the Companies operating under the FXOpen brand only (excluding FXOpen EU). It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

-

Nvidia's Successes Helps S&P 500 Price Reach Its All-time High

Yesterday, the price of the S&P 500 stock index rose to record closing highs on Thursday. Moreover, such a growth rate (+2.11% per day) has not been observed for 13 months.

Reasons for Extremely Bullish Sentiment:

→ Nvidia's report, which showed impressive earnings and prospects (the company forecasts roughly threefold revenue growth in the first quarter of 2024 amid strong demand for its AI chips). Nvidia's capitalization grew by USD 277 billion in one day — a historical record for the US stock market.

→ Positive news background for yesterday: the US Flash Manufacturing PMI index was actually = 51.5, expected = 50.5, a month ago = 50.7. Signals from the labor market were also positive - the weekly number of applications for unemployment benefits turned out to be = 201k (expected = 217k).

Technical analysis of the S&P 500 chart shows that the price continues to move within the ascending channel, which has been in effect since the beginning of 2024 (shown in blue).

Interestingly, the price of the S&P 500 made a small breakdown of the lower boundary on February 21; a similar pattern was observed on January 17 (both patterns are circled in red). In both cases:

→ after a false breakout of the lower border, a decisive breakout of the resistance level followed: in January this was the level of 4,800, yesterday, the level of 5,040 was broken.

→ The price showed signs of consolidation having reached the median line of the channel.VIEW FULL ANALYSIS VISIT - FXOpen Blog...

Disclaimer: This article represents the opinion of the Companies operating under the FXOpen brand only (excluding FXOpen EU). It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

-

Bitcoin Price Risks Not Staying above $50k

On February 14, a strong bullish impulse was recorded in the BTC/USD market, which pushed the price of bitcoin to the area above USD 50k.

The main driver of growth was the effect of the launch of a bitcoin ETF. More than a month has passed since this event, and according to media reports, the ETF has seen an influx of more than USD 7 billion. For example, BlackRock has about 125k bitcoins on its balance sheet to support its ETF fund.

Also adding to the positive mood among market participants is news about the benefits received by companies that invested in bitcoin: MicroStrategy, Block and others. Among the latest news is Reddit's decision to invest in bitcoin.

However, technical analysis of the BTC/USD chart shows alarming signs:

→ bitcoin price has slightly exceeded the upper limit of the larger ascending channel (shown in green), but how does it behave in tests? The upper border has changed its role from resistance to support (according to the classic technical analysis pattern), but rebounds from this support line quickly lose momentum. The price does not seem to have the energy (force of demand) to rise from the existing support level.

→ Bitcoin price dropped to the lower border of a smaller ascending channel (shown in blue) - a sign that the February positive is running out.Given the signs of weakening demand, it is possible that we will see an attempt by the bears to take the initiative and return the price of bitcoin below the psychological level of 50k per coin.

VIEW FULL ANALYSIS VISIT - FXOpen Blog...

Disclaimer: This article represents the opinion of the Companies operating under the FXOpen brand only (excluding FXOpen EU). It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

-

NZD/USD Technical Analysis: Bearish Start To News-heavy Week

After 8 consecutive days of growth, the price of NZD/USD is forming a bearish candle this morning, thereby indicating possible concerns among market participants at the beginning of a week full of important economic news:

→ On Wednesday, at 4:00 GMT+3, the RBNZ decision on interest rates will be published. There will also be a press conference by the leadership of the Central Bank.

→ On the same day, at 16:30 GMT+3, news about US GDP is expected.

→ On Thursday, at 16:30 GMT+3, inflation data in the United States will be published, namely Core PCE Price Index GMT+3.Note that in 2023, the NZD/USD price behaved bearishly, forming a downward channel (shown in red).

Technical analysis of the NZD/USD price chart provides confirmation of bearish sentiment in the form of a test of the 0.62 level — which showed support in early January and now appears to be resisting.

If the news acts as a driver for downward momentum:

→ the price of NZD/USD may fall towards the trend line shown in black. It is enhanced by the psychological level of 0.61.

→ This could result in a strategic reversal downwards from the area where the upper border of the red channel lies.VIEW FULL ANALYSIS VISIT - FXOpen Blog...

Disclaimer: This article represents the opinion of the Companies operating under the FXOpen brand only (excluding FXOpen EU). It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

-

The US Continues to Trump the Euro Economy on Key Metrics, But What Is Next?

A clear measure of public confidence in a national economy, as well as the ability to access a key component of it, is how many new homes are being sold compared to previous months.

There are a number of important factors that point to the overall health of a nation and its population's finances, which are demonstrated by this, for example, the ability for people to access mortgages and pay reasonable interest on the repayments, creditworthiness and the ability to repay those mortgages, and enough confidence that there will be a market for the homes that a construction company would see fit to invest in buying the land and endure the upfront costs of building homes.

Today, in the United States, new home sales figures for January 2024 will be announced, and the expected figure, according to many economic calendars, is around 680,000 new homes sold in January this year compared to 664,000 in the same period last year.

Interest rate increases have burdened mortgage holders as well as those making repayments on unsecured borrowing over recent years, and the same interest rate increases have caused corporations - including homebuilders - to have to pay more toward their monthly borrowing over this period of high-interest rates.

By their very nature, interest rate rises are designed to curb spending in order to reduce inflation, and in the context of property construction and purchase by domestic customers, it is clear that a rising interest rate would likely have an effect on buyers as well as construction companies.

However, the strength of the US economy has once again shown its mettle over the past few days, as the US Dollar has been strong against other majors. Looking at the EURUSD pair, considerable volatility has been evident. At 9.10 am UK time this morning, the EURUSD was trading at 1.08347, which shows a slight upturn in fortune for the Euro, which on February 20 had stood at 1.07750.

VIEW FULL ANALYSIS VISIT - FXOpen Blog...

Disclaimer: This article represents the opinion of the Companies operating under the FXOpen brand only (excluding FXOpen EU). It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Modify message -

AMZN Share Price Hits 25-Month High After Inclusion in DJIA Index

As of February 26, Walgreens Boots Alliance (WBA) is no longer used in the calculation of the Dow Jones Industrial Average, replaced by Amazon (AMZN).

The planned index rebalancing was carried out because:

→ Walgreens shares currently have the lowest price among all companies included in the Dow index;

→ S&P Dow Jones Indices adds Amazon as it seeks to increase the Dow's retail exposure to reflect the emerging nature of the US economy. This was also influenced by the fact that shares of the retail chain Walmart (WMT) underwent a 3:1 split.The AMZN stock chart today shows that:

→ the AMZN stock price is moving in an upward trend, its contours are indicated by a blue channel;

→ after a strong report (we wrote about this on February 5), a bullish gap formed on the chart — it is now more clearly visible between the levels of 161.5 and 166.5;

→ in the last days of winter, the price approached the upper border of the channel;

→ the price is in the upper half of the channel, and the median line (reinforced by the gap area), according to technical analysis, has the potential to provide support to it

VIEW FULL ANALYSIS VISIT - FXOpen Blog...

Disclaimer: This article represents the opinion of the Companies operating under the FXOpen brand only (excluding FXOpen EU). It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

-

European Stock Markets on All-Time Roll Despite Economic Bleakness

There has been so much clamour over the past few months relating to the flagging European economy and stagnating British economy compared to the surprisingly healthy economic situation in the United States that it would be very easy to get buried in the deluge of news articles displaying woe which have been accompanied by a rising US Dollar against a declining Euro and Pound.

However, to write off the European economy as second fiddle to that of the United States purely on the grounds of a rising Dollar, some return to form for tech stocks and a relatively mediocre set of meeting notes from the Federal Open Market Committee, which reiterated the lack of a reduction in interest rates for the near future, would be churlish, to say the least.

On the European side of the Atlantic, a more thorough inspection of the overall market conditions would soon put the flagging Euro and mainstream media speculation of recession into perspective.

Over the past few weeks, European stocks have been increasing in value to the extent that some indices have registered an all-time high.

The CAC 40 index in France concluded the European session yesterday at 7,960.8 according to FXOpen charts, which is an all-time record high for the index, which comprises the 40 most highly capitalised stocks listed on French stock exchanges.

This all-time high has been achieved following a rally which began in mid-January, showing that investor confidence in this particular index is contrary to the overall pessimism surrounding the economic strength of the Eurozone compared to other regions of major commercial importance.

This morning, the French index began at a slightly lower value than yesterday's high, with 7,925.6 displayed by FXOpen charts at 9,00am UK time.

Overall, however, this is still a very high value compared to any period in the history of the exchange prior to the record-setting activity of the past week.

VIEW FULL ANALYSIS VISIT - FXOpen Blog...

Disclaimer: This article represents the opinion of the Companies operating under the FXOpen brand only (excluding FXOpen EU). It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

-

Market Analysis: Gold Price and Crude Oil Price Eye More Upsides

Gold price started a decent increase above the $2,028 resistance level. Crude oil prices are gaining bullish momentum and might rise toward $80.00.

Important Takeaways for Gold and Oil Prices Analysis Today

· Gold price started a decent increase from the $2,015 zone against the US Dollar.· A key contracting triangle is forming with support near $2,028 on the hourly chart of gold at FXOpen.

· Crude oil prices rallied above the $76.55 and $77.00 resistance levels.

· There is a key bullish trend line forming with support at $77.80 on the hourly chart of XTI/USD at FXOpen.

Gold Price Technical Analysis

On the hourly chart of Gold at FXOpen, the price found support near the $2,015 zone. The price formed a base and started a fresh increase above the $2,020 level.There was a decent move above the 50-hour simple moving average and $2,028. The bulls pushed the price above the $2,035 resistance zone. Finally, the bears appeared near $2,040, A high was formed near $2,039.44 and the price is now consolidating gains.

The recent low was formed at $2,028 and the price is now consolidating near the 23.6% Fib retracement level of the downward move from the $2,039 swing high to the $2,028 low.

The RSI is still stable near 40 and the price could aim for more gains. Immediate resistance is near the $2,035 level. It is close to the 61.8% Fib retracement level of the downward move from the $2,039 swing high to the $2,028 low.

The next major resistance is near the $2,040 level. An upside break above the $2,040 resistance could send Gold price toward $2,050. Any more gains may perhaps set the pace for an increase toward the $2,065 level.

Initial support on the downside is near the $2,028 zone. There is also a key contracting triangle forming with support near $2,028. If there is a downside break below the $2,028 support, the price might decline further. In the stated case, the price might drop toward the $2,015 support.

Oil Price Technical Analysis

On the hourly chart of WTI Crude Oil at FXOpen, the price started a major rally against the US Dollar. The price gained bullish momentum after it broke the $77.00 resistance.VIEW FULL ANALYSIS VISIT - FXOpen Blog...

Disclaimer: This article represents the opinion of the Companies operating under the FXOpen brand only (excluding FXOpen EU). It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

-

AAPL Share Price Rises Nearly 1% after Scrapping Electric Vehicle Plans

In 2021, the release of an electric car from Apple was expected in 2025, in 2022, the deadline was shifted to 2026. As it became known yesterday from Bloomberg and WSJ, Apple decided to completely abandon the project.

Causes for this decision:

→ the electric vehicle market turned out to be not so turbulent;

→ production and technological difficulties;

→ the strong development of electric vehicle construction in China may also have played a role.Some employees will be fired, others will be transferred to a more promising department related to developments in the field of AI. Despite the fact that the ambitious project, which lasted about 10 years, failed, the price of AAPL shares rose by almost 1% yesterday as a result of trading — perhaps investors positively assessed the reorientation from electric vehicles to a more promising direction related to AI.

The AAPL stock chart shows that the level of USD 180 per share acts as support; several rebounds from it have already been formed in 2024. And the news about the abandonment of plans to produce electric vehicles caused the last of them. However, how reasonable is it to buy AAPL shares in such a situation?

Issues for bulls may include:

→ the fact that the price of AAPL is significantly weaker than stock indices, which are rewriting historical peaks thanks to NVDA, MSFT and other leaders;

→ the results of reorientation from electric vehicles to AI are a long-term and uncertain prospect;

→ from the point of view of technical analysis of AAPL stock, a downward trend appears on the chart (shown in red). Its upper border is a potential resistance line. And if there is a bearish breakout of the important USD 180 support, it could further resist the bulls' attempts to restore the AAPL share price.Also causing negativity is that:

→ the price is fixed below the black trend line;

→ MACD is in bearish territory.VIEW FULL ANALYSIS VISIT - FXOpen Blog...

Disclaimer: This article represents the opinion of the Companies operating under the FXOpen brand only (excluding FXOpen EU). It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

-

Australian Dollar Weakens amid Inflation News

According to data published today by the Australian Bureau of Statistics, the Consumer Price Index (CPI) value was: actual 3.4%, expected = 3.6%, a month ago = 3.4%, 2 months ago = 4.3%.

Data shows Australia's consumer price growth rate is slowing, approaching targets of around 2%. This means less pressure on the Reserve Bank of Australia, which is pursuing tight monetary policy to combat inflation. Thus, the prospect of lower interest rates makes the Australian dollar weaker relative to other currencies.

For example, the reaction to news about inflation in Australia, which was below expectations, was the fall in the price of AUD/USD.

Technical analysis of the AUD/USD chart shows that:

→ the price of AUD/USD continues to develop in a downward channel (shown in red);

→ the price has broken through the important level 0.6535, which served as support since last week, but now, perhaps, will again begin to provide resistance, as it did in the first half of February;

→ in February, a bearish SHS pattern formed.Bulls can be given hope by:

→ psychological level 0.6500;

→ median line of the red channel;

→ important support 0.647.Please also note:

→ today at 16:30 GMT+3, US GDP data will be published;

→ tomorrow at 16:30 GMT+3, data on the US PCE inflation index will be published.Both news have the potential to have a strong impact on the US dollar exchange rate and related markets. Be prepared for spikes in volatility.

VIEW FULL ANALYSIS VISIT - FXOpen Blog...

Disclaimer: This article represents the opinion of the Companies operating under the FXOpen brand only (excluding FXOpen EU). It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

-

The American Currency Resumes Its Growth

The American currency, despite a rather multidirectional fundamental data, resumes growth at the end of February. In the main currency pairs, one can observe both rebounds from key levels and continuation of the main trends. Thus, the USD/CAD pair managed to strengthen above 1.3500, the GBP/USD pair lost about 100 pp after rebounding from 1.2700, and EUR/USD buyers failed to strengthen above 1.0900.

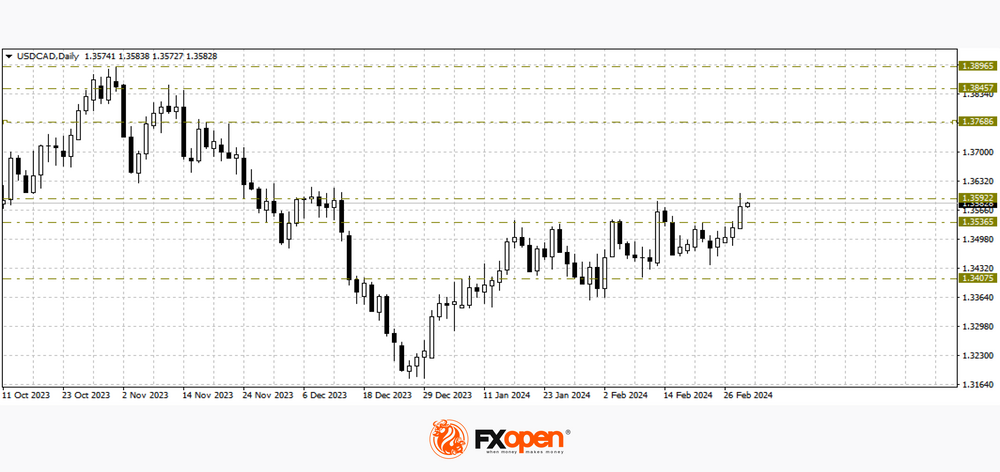

USD/CAD

Fluctuations in the oil market contributed to the strengthening of the USD/CAD pair. At the beginning of the week, sellers of the pair tried to break the support at 1.3400, but, as we see, were unsuccessful. Yesterday, the price on the USD/CAD chart not only strengthened above 1.3500, but also updated the current year’s maximum at 1.3580. If the pair's buyers do not lose their upward momentum, the price may strengthen to 1.3770-1.3700. The upward scenario may be cancelled by consolidation below the level of 1.3400.

Today, we can expect increased volatility in the pair. At 16:30 GMT+3, we are waiting for data on Canadian GDP for the fourth quarter of last year. At the same time, the basic price index of personal consumption expenditures in the US for January and indicators on applications for unemployment benefits for the current week will be published.

GBP/USD

At the end of last week, buyers of the British currency tried to break through the important resistance level at 1.2700. For about four trading sessions, the price on the GBP/USD chart was trading near this level, and yesterday it fell to 1.2620. If sellers of the pair manage to develop a downward movement, the pair may test the January lows of this year at 1.2530-1.2510.VIEW FULL ANALYSIS VISIT - FXOpen Blog...

Disclaimer: This article represents the opinion of the Companies operating under the FXOpen brand only (excluding FXOpen EU). It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

-

BTC/USD Price Exceeds $60,000 Per Coin

Several factors contributed to this:

→ Effect associated with the approval of Bitcoin ETF. The media writes that investments in these financial instruments amount to about 9k bitcoins per day, and miners produce only 900 bitcoins per day. The total investment in the Bitcoin ETF after approval on January 11 is approaching USD 50 billion. By comparison, just over USD 90 billion is invested in the 19 largest gold ETFs.

→ Expectations that Ethereum ETFs will be approved in the future, simplifying access to investments in the second largest cryptocurrency by capitalization.

→ Expectations for the Fed to cut interest rates. Cheaper credit means greater appetite for investment in higher-risk assets.

→ Expectations for the halving (scheduled for April), after which a bull market usually begins.

In mid-February, we wrote that the price of Bitcoin did not show bullish progress after exceeding the psychological level of USD 50k per Bitcoin. Technical analysis of the Bitcoin chart shows that this was due to resistance (shown by the arrow) from the median line of the green ascending channel, within which the market has been developing since the fall of 2023. Yesterday's rise, which followed the breakdown of the psychological level of 60k US dollars per bitcoin, marked the upper limit of this channel just above 64k US dollars per bitcoin and made it possible to update its contours.

Now the upper limit of the green channel acts as resistance, it is possible that after an increase of +25% in 2.5 days from point A to point B, buyers will want to take profits — this confirms the fact of yesterday's bearish impulse, in which the price of Bitcoin dropped from USD 64k to USD 59k.

So it is safe to assume that the market is ready for consolidation. But if the extremely optimistic growth rate shown by the blue lines continues, the price of Bitcoin could reach an all-time high of USD 67.7k as soon as spring arrives.

VIEW FULL ANALYSIS VISIT - FXOpen Blog...

Disclaimer: This article represents the opinion of the Companies operating under the FXOpen brand only (excluding FXOpen EU). It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

-

USD/JPY Technical Analysis: Yen Strengthens after Comments from Japanese Officials

This week has raised alarm bells for USD/JPY market participants who are trading the bullish momentum that has been going on since early 2024 (shown in the blue curved lines on the USD/JPY chart):

→ Vice Finance Minister Masato Kanda warned against “excessive volatility” in currency markets, hinting that the yen had weakened too much.

→ Bank of Japan board member Hajime Takata said that, in his opinion, there are prospects for achieving the inflation target of 2%, which opens the way to abandoning negative rates. Note that today there was news on inflation in Japan, which showed that it is slowing down. Thus, BOJ Core CPI in annual terms was 2.6%, a month ago = 2.6%, 2 months ago = 2.7%, 3 months ago = 3.0%.Statements from officials should increase the likelihood of a rate hike at the Bank of Japan's March meeting, thereby changing the prevailing sentiment.

Reuters writes that positions against the yen are at a record high, and their collapse could lead to the fact that the 2-month bullish trajectory of the USD/JPY price will be broken.

Wherein:

→ the psychological level factor of 150 yen per US dollar operates in the market — history shows that the fall of the yen below this level leads to a reaction from the Japanese financial authorities.

→ The USD/JPY price may fall to the support zone, which is formed by the level 148.50 (50% of the A→B impulse) and the level 148.8 (former resistance).VIEW FULL ANALYSIS VISIT - FXOpen Blog...

Disclaimer: This article represents the opinion of the Companies operating under the FXOpen brand only (excluding FXOpen EU). It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

-

Nasdaq-100 Price Hits All-time High after 4 Straight Months of Gains

The Nasdaq-100 index is holding above 18,000 today following yesterday's bullish momentum, fueled by inflation news.

The PCE consumer spending index amounted to 0.4% on a monthly basis, which was in line with analysts' expectations. A year ago, we recall, it was 0.6%. Thus, statistics indicate a weakening of inflation which means that the likelihood of the Fed cutting interest rates increases — the anticipation of this event increases optimism in the stock market.

Another driver is the strong price action of NVDA stock. The company's capitalization is close to USD 2 trillion, as Nvidia is perhaps the main beneficiary of the AI boom — NVDA's price rose approximately 28% in February.

The Nasdaq-100 chart shows that the index price has been in an upward trend since the beginning of 2024 (shown by the blue channel):

→ with the price is in its upper half;

→ from the point of view of technical analysis of the Nasdsaq-100, the level of 18k points, which acted as resistance in February, may support the market in March — however, this is if the bulls manage to gain a foothold above 18,000.In the meantime, the current exceeding of maximum 2 looks insignificant. And this creates the threat of a false bullish breakout — as an example, this turned out to be the maximum 2, when the price exceeded the maximum 1. Let's note another bearish factor, the overbought state on the RSI indicator.

VIEW FULL ANALYSIS VISIT - FXOpen Blog...

Disclaimer: This article represents the opinion of the Companies operating under the FXOpen brand only (excluding FXOpen EU). It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

-

Price of Gold Briefly Exceeded $2,050 per Ounce

In addition to new records in the stock markets, the reaction to yesterday's news about inflation in the US was also a decrease in government bond yields and a rapid rise in the price of gold — the cost of XAU/USD jumped by 0.9% in just one hour, while the day's high exceeded USD 2,050 per ounce .

However, on Friday morning the price of XAU/USD dropped below USD 2,040 – did market participants misjudge the impact of US inflation on the price of gold?

XAU/USD chart shows that:

→ the price of gold is in a downward trend (shown in red);

→ yesterday, the price not only touched the psychological level of USD 2,050, but also reached the upper limit of the downward red channel. That is, both lines acted as a block of resistance, which appears to be a serious obstacle to the upward impulse (shown by blue lines).A sharp change in sentiment (yesterday, positive, today, negative) may be similar to a sharp change in mood (in a mirror image) that happened in mid-February. As the blue arrows show, the negativity caused by the price falling below the psychological level of USD 2,000 within a few days was replaced by positive sentiment.

Therefore, it is possible that the activation of the bears, noticeable in the action of the price of gold this morning, may result in an attempt to resume the development of the market trend within the red channel. The nearest serious test of the seriousness of the bears' intentions may be the lower blue line, which worked as support in the second half of February.

VIEW FULL ANALYSIS VISIT - FXOpen Blog...

Disclaimer: This article represents the opinion of the Companies operating under the FXOpen brand only (excluding FXOpen EU). It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

-

WTI Oil Price Reaches 4-month High against the Backdrop of OPEC+ Decision

On Friday, the price of a barrel of WTI crude oil exceeded USD 80 per barrel due to the decision to continue the policy of reducing oil production by OPEC+ countries.

Saudi Arabia said on Sunday it would extend oil production cuts until June to “maintain stability and balance in oil markets,” an official statement said. Kuwait and the United Arab Emirates also said they would also continue cuts.

NYT writes that the decision was expected. At the same time, the price of WTI oil exceeded USD 80 per barrel on Friday for the first time since the beginning of November 2023.

The price chart for WTI oil shows that the market has been in an upward trend since mid-December - the price has formed an upward channel (shown in blue). In addition to the OPEC+ policy, the strength of demand is also supported by:

→ uncertainty in the military conflict between Hamas and Israel;

→ facts of attacks on oil tankers in the Red Sea.Will the price be able to consolidate at the peak reached? Arguments against the development of such a scenario are provided by a technical analysis of the WTI oil price chart:

→ the price is at the upper border of the ascending blue channel (that is, near the resistance line);

→ the USD 80 level can act as psychological resistance with the formation of a false breakout pattern;

→ the top formed on Friday is in the resistance area of the Fibonacci level of 50% of the decline A→B.VIEW FULL ANALYSIS VISIT - FXOpen Blog...

Disclaimer: This article represents the opinion of the Companies operating under the FXOpen brand only (excluding FXOpen EU). It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

-

5 Stocks To Consider in March 2024

Here we are, beginning the last month of the first quarter of 2024, which has passed by in somewhat of a flash.

Perhaps the apparent speed at which the spring is approaching can be attributed to what appears to be a single issue among analysts and market participants since the beginning of the year, that being the anticipation of announcements by central banks in Western countries with regard to monetary policy. Put simply, is the rate of interest going down?

Rather interestingly, it did not. The United States led the charge of announcements relating to monetary policy this year, and contrary to popular belief, the interest rates have not been reduced. The equities and commodities markets have had extra factors to consider, including logistical dire straits in the Red Sea, meaning products cannot reach their destination as freely as last year, and OPEC+ countries looking at production cut extensions in front of a backdrop of war in the Eastern Mediterranean region.

The markets have been somewhat volatile, which means trading activity remains interesting. Here are five interesting stocks to look at this month.

- eBay

Over the past few weeks, eBay stock has been demonstrating strong performance, with a continued overall upward direction since mid-January, with just a few blips on the way.

Last week, the e-commerce giant reported its earnings for the fourth quarter of 2023, which came to a remarkable $728 million, translating to $1.07 a share, compared with a net income figure of $671 million in the same quarter in 2022.

That led to a healthy increase in stock value. However, the real eye-catcher is what happened during the trading day on Thursday, February 28.

Suddenly, eBay stock rose from $44.32 on October 27 to $47.81 according to FXOpen charts, a considerable increase which continued to build, ending the trading day on Friday, March 1, at $47.97.

This sudden jump in value occurred a few days after the market's reaction to the positive results, and it is interesting indeed. eBay's high level of prominence in areas such as online advertising banner sales, fees from auction sales from private sellers, and premium listings from commercial sellers has led it to be the de facto marketplace for most of the world. Jumps like this are rare for such highly capitalised companies, so a keen eye will likely be on eBay's movements in the next few days.

- China Construction Bank (HK)

China Construction Bank is one of the largest banks in the world by market capitalization and is among the four largest banks in mainland China.

Its origins lie deeply rooted in state ownership, as is commonplace within the planned economy under which the People's Republic of China operates, and it was brought into being by the People's Bank of China, which is the Chinese central bank, beginning to spin off its commercial banking operations.

Considering its vastness and that it is such a vast corporation operating within the world's largest and most diversified economy, share prices within the Hong Kong-listed entity have been somewhat volatile recently.

During the course of the summer of last year, reports emerged stating that investors in the China Construction Bank (HK)'s stock had lost 13% over the past five years, clearly stating the long period of sustained losses, which are juxtaposition to the bank's massive might.

During the first few weeks of this year, China Construction Bank's Hong Kong-listed stock has been volatile, to say the least.

On January 3, the stock was trading at a low of $4.29HKD on FXOpen; however, by February 26, it had rallied to $4.95HKD before beginning to decrease again.

This is an inordinately low-value stock, which demonstrates the difference in tradability between Western banking giants and those with their origins in China. A leftfield one to look at, but interesting nonetheless.

- Coinbase

The endless news coverage about cryptocurrencies may have died down long ago, but the major digital asset exchanges are still very much alive and well.

Many of the large exchanges, such as Coinbase and Binance, got their product right in the design of intuitive trading applications, which attracted and retained a young, analytical audience. The euphoria that surrounded the cryptocurrency market in 2020 and 2021 may have ebbed away, but the extent to which many of the large exchanges went in order to provide proprietary apps that make sure they promote their brand in a way that ensures loyalty remains. Coinbase stock rocketed from $116.79 on February 5 to $208.35, according to FXOpen pricing on February 28.

That is a substantial increase in value and is without any mention of huge numbers of new crypto traders or meme boards creating their own markets, such as was the case 3 years ago.

- Lucid Group

Newly founded electric vehicle companies which have entered a somewhat conservative arena of car manufacturing often bask in the shadow of uber-disrupter Tesla, and many managed to make their way onto public stock exchanges via unorthodox SPAC listings rather than the hard slog that is years of heavy manufacturing and showing good balance sheets and economies of scale which is the way of the 140-year old motor industry's most recognised corporations. North America's Lucid Group is no exception. It is a relatively low-value stock and is a very well-established company; however, volatility has been the order of the day for some time now.

In mid-December last year, Lucid Group stock reached a sudden peak of $5.22 per share, according to FXOpen pricing, a value reached after a quick but short-lived rally. By January 19, it was down to $2.61 before heading back up to $3.50 on January 1. Since then, the share price has been erratic, to say the least.

Just two days ago, the company released its annual report, which was a damp squib. Earnings were 3.9% less than analyst estimates at US$595 million, and statutory losses were in line with analyst expectations at US$1.36 per share.

It seems there are those who believe in the new firms capitalizing on the electric vehicle revolution. However, it is hard to ignore the plethora of electric vehicles now on the market by some of the world's oldest and most established manufacturers, which are easily capable of ensuring that these new entrants could only ever be considered fringe players with an eccentric image.

- Rivian Automotive

In a rather similar vein to that of Lucid Group, electric truck manufacturer Rivian Automotive has been experiencing volatility; however, in the case of Rivian, it has been in a solid downward direction recently.

From a high point of $24.25 on December 19, Rivian stock has been plummeting, resting briefly at $15.37 on February 21 before crashing suddenly to $10.09 on February 26, according to FXOpen pricing.

VIEW FULL ANALYSIS VISIT - FXOpen Blog...

Disclaimer: This article represents the opinion of the Companies operating under the FXOpen brand only (excluding FXOpen EU). It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Modify message - eBay

-

Swiss Franc Weakens after Inflation News

Inflation in the country fell in February to its lowest level in nearly two-and-a-half years, data from Switzerland's Federal Statistical Office showed on Monday. Although consumer prices rose 1.2% compared to a year earlier, there is reason to believe that inflation is slowing down compared to the 1.3% recorded a month earlier.

Reuters writes that the Swiss National Bank has kept inflation rates within the target range since May 2023, despite rising rents, sales taxes and energy prices. And the latest news makes it more likely that the SNB will cut rates at its next meeting, scheduled for March 21.

Thus, market participants can expect a looser policy and an affordable franc — which is why the CHF has weakened against a number of currencies. For example, the EUR/CHF rate has reached its highest level since November 2023.

Wherein:

→ the price has broken through the downward channel (shown in red), which has been in effect since last summer — it seems that it is already losing relevance;

→ since the beginning of the year, the rate has already increased by more than 3.5%, which allows us to outline trend lines (shown in blue);

→ levels 0.94730 and 0.95580 changed their behaviour from resistance to support;

→ daily RSI indicates that after strong growth, the market is in the overbought zone, which creates the preconditions for the formation of a correction.If the growth continues, an important test of the seriousness of the bulls’ intentions may be the level of 0.96800 – near which important reversals in the EUR/CHF price were previously formed.

VIEW FULL ANALYSIS VISIT - FXOpen Blog...

Disclaimer: This article represents the opinion of the Companies operating under the FXOpen brand only (excluding FXOpen EU). It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.