Market Analysis By FXOpen

-

Bitcoin Price Exceeds Psychological Level of $50k

The last time the BTC price was above $50,000 was in December 2021, making its way to the low around $15,500 reached in November 2022.

Reaching the $50,000 level was facilitated by:

→ waiting for the halving, after which the price of Bitcoin is believed to receive a bullish impulse due to a reduction in supply;

→ the effect of the approval of a Bitcoin ETF;

→ expectation of easing of the Fed's monetary policy, which increases interest in risky assets. By the way, the Nasdaq-100 technology stock index set a historical high yesterday, breaking the level of 18,000 points.

At the same time, the BTC/USD chart shows that:

→ the price of Bitcoin moves within an ascending channel (shown in blue), which dates back to last fall;

→ from the point of view of technical analysis, with this channel construction, the price of Bitcoin still has some room to rise to its upper limit.However, please note that:

→ the widely known crypto fear and greed index has a value of 79 out of 100, indicating extreme greed;

→ the RSI indicator is in the overbought zone and is forming a bearish divergence pattern, which is a sign of weakening buying pressure;

→ exceeding the psychological level can result in a false breakout, as was the case with a short-term decline in the price of Bitcoin below the support level of 40,000.VIEW FULL ANALYSIS VISIT - FXOpen Blog...

Disclaimer: This article represents the opinion of the Companies operating under the FXOpen brand only (excluding FXOpen EU). It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Modify message -

Moved from Earnings by

Ivan Ivanov

Ivan Ivanov

-

Ethereum Price Exceeds $2,800

The last time the ETH/USD price was at this level was in May 2022, which was the start of a massive drop of more than 65% in 1.5 months.

However, now the ETH/USD market is dominated by bullish sentiment, for the following reasons:

→ deployment of the Dencun update on the Ethereum network this month, which will open up new opportunities for users and developers;

→ expectations that this year, following the approval of Bitcoin ETFs, applications for the launch of ETFs on Ethereum will be approved;

→ waiting for a traditional bull market after halving in the Bitcoin network.

So far, the ETH/USD chart shows that the price of Ethereum is moving within an ascending channel that begins in 2023. Moreover, the price is in its upper half — an indication of the strength of demand. If the trend continues, the price of Ethereum could reach $3,000 within a month.

At the same time, the price of Ethereum is approaching the upper border of the channel, which may provide resistance. It is possible that the indicators will indicate that the market is overbought, creating the preconditions for the formation of a correction.

VIEW FULL ANALYSIS VISIT - FXOpen Blog...

Disclaimer: This article represents the opinion of the Companies operating under the FXOpen brand only (excluding FXOpen EU). It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

-

TSLA Share Price Rises Sharply amid News of Musk's Increased Stake in the Company

According to media reports, Elon Musk has increased his stake in Tesla by more than one and a half times — previously, the billionaire owned approximately 13% of the shares, now he owns 20.5% of Tesla. And earlier it was reported that Musk wants to increase his stake in Tesla to at least 25%.

At the same time, the TSLA share price rose sharply in yesterday's trading by more than 6%, while the S&P 500 stock market index increased by “only” +0.6%.

The TSLA stock chart today shows that:

→ the price has overcome the psychological mark of USD 200 per share;

→ the price has overcome the resistance level of USD 195 per share;

→ a bullish reversal pattern inverted head-and-shoulders has formed on the chart.The situation gives hope to the bulls in a disadvantageous situation, because:

→ TSLA stock price is in a bearish trend (as shown by the red channel);

→ the last quarter report disappointed investors — and the price formed a wide bearish gap at the end of January.VIEW FULL ANALYSIS VISIT - FXOpen Blog...

Disclaimer: This article represents the opinion of the Companies operating under the FXOpen brand only (excluding FXOpen EU). It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

-

GBP/JPY: Price Corrects from 8.5 Year High

According to CNN, the economies of the UK and Japan entered a technical recession last week as data showed a second consecutive quarterly decline in gross domestic product. And if in the UK the economic downturn can be associated with high inflation and the strict policies of the Bank of England, then in Japan the reason may be the population decline (which has been going on for 14 years in a row).

At the same time, the GBP/JPY chart shows that last week the rate exceeded 190 yen per pound for the first time since August 2015.

However:

→ the price is at the upper border of the ascending channel (shown in blue);

→ at the beginning of this week, the price of GBP/JPY is below the 190 yen level – and a false bullish breakout of the psychological level should be regarded as a bearish sign;

→ the MACD indicator indicates that demand forces are fading.Perhaps market participants are inclined to take profits from longs. Since it is possible that the Japanese authorities are able to announce some decisions aimed at supporting the yen. In this case, one of the immediate targets for the bears may be the level of 186 yen per pound – where the support level (formerly the resistance level) is located, reinforced by the median line of the long-term channel.

VIEW FULL ANALYSIS VISIT - FXOpen Blog...

Disclaimer: This article represents the opinion of the Companies operating under the FXOpen brand only (excluding FXOpen EU). It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

-

Is the UK really in a recession? Perhaps 2024 data will be different

It's Monday morning, and a deluge of doom and gloom relating to a recession having begun in the United Kingdom is abound.

Many mainstream news channels, along with analyses coming from a number of financial markets commentators, are outlining the potential contraction of the British economy should the central bank monetary policy remain hardline regarding interest rates.

There is a school of thought which warns investors that if the Bank of England does not decide to reduce interest rates, the British economy would perhaps become less competitive, and language such as causing a worsening of an existing recession could take place.

This is a very intriguing view, however, because the British Pound has been performing against other major currencies in a pattern that would suggest anything but a recession is even existent, let alone in full swing as is being touted by many reports.

During the course of this year so far, the British Pound has been gaining value significantly against the Euro, with the EURGBP pair having hit 0.850 at the bottom of the market on February 14, according to FXOpen charts, a far cry from its 0.869 value on January 1.

Indicative pricing only

A gross domestic product (GDP) figure which reduced by 0.3% between October and December 2023 was released this morning by the Office of National Statistics, which is one of the factors that have caused observers to consider the British economy to be slipping into a recession - a recession being quantified by a national economy contracting for more than six consecutive months during an annual period, however if a wider view is taken, central bank policy across many Western nations has been similar for quite some time now, that being to maintain interest rates at relatively high levels in order to attempt to curb spending.Should such a policy go to plan, it may well affect overall GDP as large companies and small businesses alike may scale back operations to reduce costs as they have to pay more each month to service debt commitments and also to meet lower demand for products at a time during which interest rates are high.

VIEW FULL ANALYSIS VISIT - FXOpen Blog...

Disclaimer: This article represents the opinion of the Companies operating under the FXOpen brand only (excluding FXOpen EU). It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

-

Will investors focus on commodities in the advent of tomorrow's FOMC Minutes?

Just over a day remains before the Federal Open Market Committee (FOMC) in the United States is set to release the minutes from its policy meeting, which was held at the end of January.

Ordinarily, announcements such as this are considered to be very important events in the global economic calendar, especially given that monetary policy, which the FOMC is responsible for administering, has been a very significant feature during these prolonged times of high-interest rates and stringent rulings by central banks across Western markets which have continued despite the high levels of inflation which ran into double figures being long since a thing of the past.

Perhaps the forthcoming publication of the minutes from the FOMC meeting, which took place on the final days of January, will not reveal any particular new matters of interest, largely because it is already widely understood that the US authorities will not be reducing interest rates in the foreseeable future, contrary to the understanding of many analysts and investors at the beginning of this year.

Given that Federal Reserve chairman Jerome Powell underscored the decision in a message at the beginning of February by saying that the Federal Reserve will not cut rates until it is certain that inflation is nearing the 2% target, it appears that any such minutes from a more recent meeting are not likely to affect the market that much.

In times during which the market expects a favourable approach by central bankers which will accelerate the economy, such as rate cuts which were anticipated for March and June this year, which do not materialise, it is often the case that attention turns to commodities.

Over the past few days, spot gold has been increasing in value.

On February 13, spot gold was at its lowest value this year, trading at $1,990.69 per troy ounce at the bottom end of the candlestick, according to FXOpen pricing. This low point reversed, and spot gold has made a remarkable return over the past week, entering the market this morning across European time zones at just over $2,021 per troy ounce.

VIEW FULL ANALYSIS VISIT - FXOpen Blog...

Disclaimer: This article represents the opinion of the Companies operating under the FXOpen brand only (excluding FXOpen EU). It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

-

NASDAQ Price Declining Ahead of NVDA Report

E-mini NASDAQ 100 futures fell below the psychological 17,500 level yesterday after trading above 18,000 on Friday.

The reason for the decline may be the fears of market participants ahead of the news release:

→ today after the close of the main trading session, Nvidia, the 5th largest company by capitalization, will publish its report;

→ today at 22:00 GMT+3, data from the Federal Reserve will be published, which will provide important information about the prospects for lowering the interest rate.However, for now the decline looks like a correction.

The NASDAQ 100 chart shows that:

→ the price is within an uptrend (shown by a blue channel);

→ the level of 18000 acted as psychological resistance, as the price turned down after a small puncture;

→ the price fixes below the local ascending channel (shown by purple lines).For now, the support level at 17,500 is keeping the price from falling further, but if the news is disappointing, the price may drop to the lower border of the channel — it is even possible that the bears will attempt a breakout.

VIEW FULL ANALYSIS VISIT - FXOpen Blog...

Disclaimer: This article represents the opinion of the Companies operating under the FXOpen brand only (excluding FXOpen EU). It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

-

S&P 500 Inches Down After Long Rally as FOMC Minutes Approach

Aside from the performance of a national currency, a popular yardstick by which to gauge anticipation or reaction to an economic event or announcement is the market sentiment surrounding the top listed stocks on premier exchanges.

Today, as market participants around the world await the release of the minutes from the FOMC meeting that took place at the end of January, the S&P 500 index will begin trading slightly lower, an interesting movement considering that for the past three months, this premier index which includes the most prestigious and highly capitalised publicly listed companies listed on US exchanges, has been rallying.

Since the end of October, only a few minor dips have taken place. However, the tailing off which took place during the New York trading session yesterday places the S&P 500 under the 5,000 point mark when the market opens in New York today.

On February 19, the S&P 500 finished the trading day (Eastern Standard Time) at 5,008.7, according to FXOpen charts and will begin the trading session today at 4,973.6, which is its closing price yesterday.

There is some degree of speculation as to whether the FOMC minutes will provide any indication of the Federal Reserve Bank's potential view toward reducing interest rates, however considering that a far higher level of speculation abounded at the beginning of this year with so many market analysts adamant that rates would be lowered twice before the end of the summer in the United States when in reality the Federal Reserve had not given any such signal and then categorically announced that it was not planning to reduce rates in the near future.

Therefore, there are other factors likely being considered by investors, and an overall conservative path is being trodden, especially when considering that not only the S&P 500 dipped below the 5,000 mark at a time when it was previously rallying - let's remember that the S&P 500 index had a bumper year in 2023, having risen by 24% across the entirety of the year.

VIEW FULL ANALYSIS VISIT - FXOpen Blog...

Disclaimer: This article represents the opinion of the Companies operating under the FXOpen brand only (excluding FXOpen EU). It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

-

Ethereum Price Falls after Exceeding $3,000

We previously wrote about the reasons for the positive sentiment in the ETH/USD market.

Optimism was added by a post on X (Twitter) by Vitalik Buterin about the so-called Werkle trees. This technology, which should (according to the information in the roadmap) be introduced in the future, it includes the advantages of:

→ reduced requirements for validators;

→ faster network synchronization, and others.The ETH/USD chart shows that:

→ ETH price is within a larger uptrend (shown in orange);

→ the price is within the February bullish trend (shown by blue lines);

→ the market is in an overbought state, judging by the bearish divergence on the MACD indicator.These arguments suggest that the market is vulnerable to a pullback.

Notice the wide bearish candle (shown by the red arrow) that is pushing the ETH price down from above the psychological USD 3,000 level. It may indicate a change in mood.

Since the beginning of February, the price of ETH has increased by approximately 30%. Therefore, some market participants could take profits from long positions at the psychological level. If a pullback occurs and is about 50% of the February rise, the price of Ethereum may fall to the median line of the orange channel to the support area of 2,700.

VIEW FULL ANALYSIS VISIT - FXOpen Blog...

Disclaimer: This article represents the opinion of the Companies operating under the FXOpen brand only (excluding FXOpen EU). It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

-

NVDA Share Price Soars 11% after Report

The signs of concern we wrote about yesterday have largely subsided. After three days of declines, the price of E-mini Nasdaq 100 futures bounced off the lower boundary of the channel (see yesterday's chart) and rose, led by NVDA stock.

Nvidia's quarterly report exceeded expectations:

→ earnings per share: actual = USD 5.16, expected = USD 4.59;

→ gross revenue: actual = USD 22.10 billion, expected = USD 20.39 billion.According to the head of the company:

→ Accelerated computing and generative AI have reached a tipping point.

→ Demand for computing is growing worldwide among companies, industries and governments.

→ The coming year will bring major new product cycles with exceptional innovations that will help propel the industry forward.In post-market trading, NVDA's price rose 11% to over USD 740 per share. Thus, the price increase for NVDA since the beginning of 2024 is about 50%.

The NVDA stock chart shows that:

→ the USD 740 level acted as resistance in February;

→ however, taking into account the post-market price, we can assume that today at the opening of trading this resistance level will be broken and in the future, according to the logic of technical analysis, will begin to provide support;

→ in this case, a rebound will be formed from the lower line of the channel (shown in blue) and a wide bullish gap.VIEW FULL ANALYSIS VISIT - FXOpen Blog...

Disclaimer: This article represents the opinion of the Companies operating under the FXOpen brand only (excluding FXOpen EU). It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Modify message -

Commodity Currencies Strengthen after the FOMC Minutes Publication

The fundamental data of recent trading sessions contributed to a slight strengthening of commodity and European currencies. Thus, the AUD/USD pair, after forming a bullish engulfing combination, managed to confidently gain a foothold above 0.6500. The pound/US dollar currency pair retested the support at 1.2540 and went above 1.2600, and greenback sellers in the US dollar/loonie pair are trying to break the support at 1.3500.

GBP/USD

The price of the pound on the GBP/USD chart has been trading for the third week in a rather narrow range of 1.2680-1.2540. Apparently, to enter new positions, investors need a more important foundation than the publication of the FOMC protocols. The head of the Bank of England, Andrew Bailey, whose speech took place on Tuesday at 13:15 GMT+3, also failed to inspire market participants to make new entries.Today at 12:30 GMT+3, we are waiting for the publication of data on the business activity index in the UK services sector for February. At 17:45 GMT+3, the business activity index (PMI) in the US services sector for the same period will be released. Also at 18:00 GMT+3, data on sales on the secondary housing market for January will be published, and at the very beginning of the American session, weekly figures on the number of applications for unemployment benefits will be released.

USD/CAD

Sellers of the USD/CAD pair managed to close yesterday with a reversal combination to sell dark clouds. If we receive confirmation of this formation on the USD/CAD chart, we can expect a repeat approach to 1.3400-1.3370.Today at 16:30 GMT+3, we are waiting for the publication of the basic retail sales index in Canada for December. Also at 19:00 GMT+3, data on crude oil inventories in the United States for the last week will be released.

VIEW FULL ANALYSIS VISIT - FXOpen Blog...

Disclaimer: This article represents the opinion of the Companies operating under the FXOpen brand only (excluding FXOpen EU). It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

-

Market Analysis: AUD/USD and NZD/USD Grind Higher Steadily

TAUD/USD is moving higher and might rally if it clears 0.6600. NZD/USD is also rising and could extend its increase above the 0.6220 resistance zone.

Important Takeaways for AUD/USD and NZD/USD Analysis Today

· The Aussie Dollar is moving higher from the 0.6540 zone against the US Dollar.· There is a key bullish trend line forming with support at 0.6555 on the hourly chart of AUD/USD at FXOpen.

· NZD/USD is showing positive signs above the 0.6180 support.

· There is a major bullish trend line forming with support at 0.6190 on the hourly chart of NZD/USD at FXOpen.

AUD/USD Technical Analysis

On the hourly chart of AUD/USD at FXOpen, the pair remained stable near the 0.6500 zone, as discussed in the previous analysis. The Aussie Dollar formed a base and started a decent increase above the 0.6540 resistance against the US DollarThe bulls pushed the pair above the 0.6550 resistance zone. There was a close above the 0.6565 resistance and the 50-hour simple moving average.

The pair is now consolidating near the 50% Fib retracement level of the downward move from the 0.6595 swing high to the 0.6542 low. On the upside, the AUD/USD chart indicates that the pair is now facing resistance near 0.6575.

VIEW FULL ANALYSIS VISIT - FXOpen Blog...

Disclaimer: This article represents the opinion of the Companies operating under the FXOpen brand only (excluding FXOpen EU). It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

-

Nvidia's Successes Helps S&P 500 Price Reach Its All-time High

Yesterday, the price of the S&P 500 stock index rose to record closing highs on Thursday. Moreover, such a growth rate (+2.11% per day) has not been observed for 13 months.

Reasons for Extremely Bullish Sentiment:

→ Nvidia's report, which showed impressive earnings and prospects (the company forecasts roughly threefold revenue growth in the first quarter of 2024 amid strong demand for its AI chips). Nvidia's capitalization grew by USD 277 billion in one day — a historical record for the US stock market.

→ Positive news background for yesterday: the US Flash Manufacturing PMI index was actually = 51.5, expected = 50.5, a month ago = 50.7. Signals from the labor market were also positive - the weekly number of applications for unemployment benefits turned out to be = 201k (expected = 217k).

Technical analysis of the S&P 500 chart shows that the price continues to move within the ascending channel, which has been in effect since the beginning of 2024 (shown in blue).

Interestingly, the price of the S&P 500 made a small breakdown of the lower boundary on February 21; a similar pattern was observed on January 17 (both patterns are circled in red). In both cases:

→ after a false breakout of the lower border, a decisive breakout of the resistance level followed: in January this was the level of 4,800, yesterday, the level of 5,040 was broken.

→ The price showed signs of consolidation having reached the median line of the channel.VIEW FULL ANALYSIS VISIT - FXOpen Blog...

Disclaimer: This article represents the opinion of the Companies operating under the FXOpen brand only (excluding FXOpen EU). It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

-

Bitcoin Price Risks Not Staying above $50k

On February 14, a strong bullish impulse was recorded in the BTC/USD market, which pushed the price of bitcoin to the area above USD 50k.

The main driver of growth was the effect of the launch of a bitcoin ETF. More than a month has passed since this event, and according to media reports, the ETF has seen an influx of more than USD 7 billion. For example, BlackRock has about 125k bitcoins on its balance sheet to support its ETF fund.

Also adding to the positive mood among market participants is news about the benefits received by companies that invested in bitcoin: MicroStrategy, Block and others. Among the latest news is Reddit's decision to invest in bitcoin.

However, technical analysis of the BTC/USD chart shows alarming signs:

→ bitcoin price has slightly exceeded the upper limit of the larger ascending channel (shown in green), but how does it behave in tests? The upper border has changed its role from resistance to support (according to the classic technical analysis pattern), but rebounds from this support line quickly lose momentum. The price does not seem to have the energy (force of demand) to rise from the existing support level.

→ Bitcoin price dropped to the lower border of a smaller ascending channel (shown in blue) - a sign that the February positive is running out.Given the signs of weakening demand, it is possible that we will see an attempt by the bears to take the initiative and return the price of bitcoin below the psychological level of 50k per coin.

VIEW FULL ANALYSIS VISIT - FXOpen Blog...

Disclaimer: This article represents the opinion of the Companies operating under the FXOpen brand only (excluding FXOpen EU). It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

-

NZD/USD Technical Analysis: Bearish Start To News-heavy Week

After 8 consecutive days of growth, the price of NZD/USD is forming a bearish candle this morning, thereby indicating possible concerns among market participants at the beginning of a week full of important economic news:

→ On Wednesday, at 4:00 GMT+3, the RBNZ decision on interest rates will be published. There will also be a press conference by the leadership of the Central Bank.

→ On the same day, at 16:30 GMT+3, news about US GDP is expected.

→ On Thursday, at 16:30 GMT+3, inflation data in the United States will be published, namely Core PCE Price Index GMT+3.Note that in 2023, the NZD/USD price behaved bearishly, forming a downward channel (shown in red).

Technical analysis of the NZD/USD price chart provides confirmation of bearish sentiment in the form of a test of the 0.62 level — which showed support in early January and now appears to be resisting.

If the news acts as a driver for downward momentum:

→ the price of NZD/USD may fall towards the trend line shown in black. It is enhanced by the psychological level of 0.61.

→ This could result in a strategic reversal downwards from the area where the upper border of the red channel lies.VIEW FULL ANALYSIS VISIT - FXOpen Blog...

Disclaimer: This article represents the opinion of the Companies operating under the FXOpen brand only (excluding FXOpen EU). It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

-

The US Continues to Trump the Euro Economy on Key Metrics, But What Is Next?

A clear measure of public confidence in a national economy, as well as the ability to access a key component of it, is how many new homes are being sold compared to previous months.

There are a number of important factors that point to the overall health of a nation and its population's finances, which are demonstrated by this, for example, the ability for people to access mortgages and pay reasonable interest on the repayments, creditworthiness and the ability to repay those mortgages, and enough confidence that there will be a market for the homes that a construction company would see fit to invest in buying the land and endure the upfront costs of building homes.

Today, in the United States, new home sales figures for January 2024 will be announced, and the expected figure, according to many economic calendars, is around 680,000 new homes sold in January this year compared to 664,000 in the same period last year.

Interest rate increases have burdened mortgage holders as well as those making repayments on unsecured borrowing over recent years, and the same interest rate increases have caused corporations - including homebuilders - to have to pay more toward their monthly borrowing over this period of high-interest rates.

By their very nature, interest rate rises are designed to curb spending in order to reduce inflation, and in the context of property construction and purchase by domestic customers, it is clear that a rising interest rate would likely have an effect on buyers as well as construction companies.

However, the strength of the US economy has once again shown its mettle over the past few days, as the US Dollar has been strong against other majors. Looking at the EURUSD pair, considerable volatility has been evident. At 9.10 am UK time this morning, the EURUSD was trading at 1.08347, which shows a slight upturn in fortune for the Euro, which on February 20 had stood at 1.07750.

VIEW FULL ANALYSIS VISIT - FXOpen Blog...

Disclaimer: This article represents the opinion of the Companies operating under the FXOpen brand only (excluding FXOpen EU). It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Modify message -

AMZN Share Price Hits 25-Month High After Inclusion in DJIA Index

As of February 26, Walgreens Boots Alliance (WBA) is no longer used in the calculation of the Dow Jones Industrial Average, replaced by Amazon (AMZN).

The planned index rebalancing was carried out because:

→ Walgreens shares currently have the lowest price among all companies included in the Dow index;

→ S&P Dow Jones Indices adds Amazon as it seeks to increase the Dow's retail exposure to reflect the emerging nature of the US economy. This was also influenced by the fact that shares of the retail chain Walmart (WMT) underwent a 3:1 split.The AMZN stock chart today shows that:

→ the AMZN stock price is moving in an upward trend, its contours are indicated by a blue channel;

→ after a strong report (we wrote about this on February 5), a bullish gap formed on the chart — it is now more clearly visible between the levels of 161.5 and 166.5;

→ in the last days of winter, the price approached the upper border of the channel;

→ the price is in the upper half of the channel, and the median line (reinforced by the gap area), according to technical analysis, has the potential to provide support to it

VIEW FULL ANALYSIS VISIT - FXOpen Blog...

Disclaimer: This article represents the opinion of the Companies operating under the FXOpen brand only (excluding FXOpen EU). It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

-

European Stock Markets on All-Time Roll Despite Economic Bleakness

There has been so much clamour over the past few months relating to the flagging European economy and stagnating British economy compared to the surprisingly healthy economic situation in the United States that it would be very easy to get buried in the deluge of news articles displaying woe which have been accompanied by a rising US Dollar against a declining Euro and Pound.

However, to write off the European economy as second fiddle to that of the United States purely on the grounds of a rising Dollar, some return to form for tech stocks and a relatively mediocre set of meeting notes from the Federal Open Market Committee, which reiterated the lack of a reduction in interest rates for the near future, would be churlish, to say the least.

On the European side of the Atlantic, a more thorough inspection of the overall market conditions would soon put the flagging Euro and mainstream media speculation of recession into perspective.

Over the past few weeks, European stocks have been increasing in value to the extent that some indices have registered an all-time high.

The CAC 40 index in France concluded the European session yesterday at 7,960.8 according to FXOpen charts, which is an all-time record high for the index, which comprises the 40 most highly capitalised stocks listed on French stock exchanges.

This all-time high has been achieved following a rally which began in mid-January, showing that investor confidence in this particular index is contrary to the overall pessimism surrounding the economic strength of the Eurozone compared to other regions of major commercial importance.

This morning, the French index began at a slightly lower value than yesterday's high, with 7,925.6 displayed by FXOpen charts at 9,00am UK time.

Overall, however, this is still a very high value compared to any period in the history of the exchange prior to the record-setting activity of the past week.

VIEW FULL ANALYSIS VISIT - FXOpen Blog...

Disclaimer: This article represents the opinion of the Companies operating under the FXOpen brand only (excluding FXOpen EU). It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

-

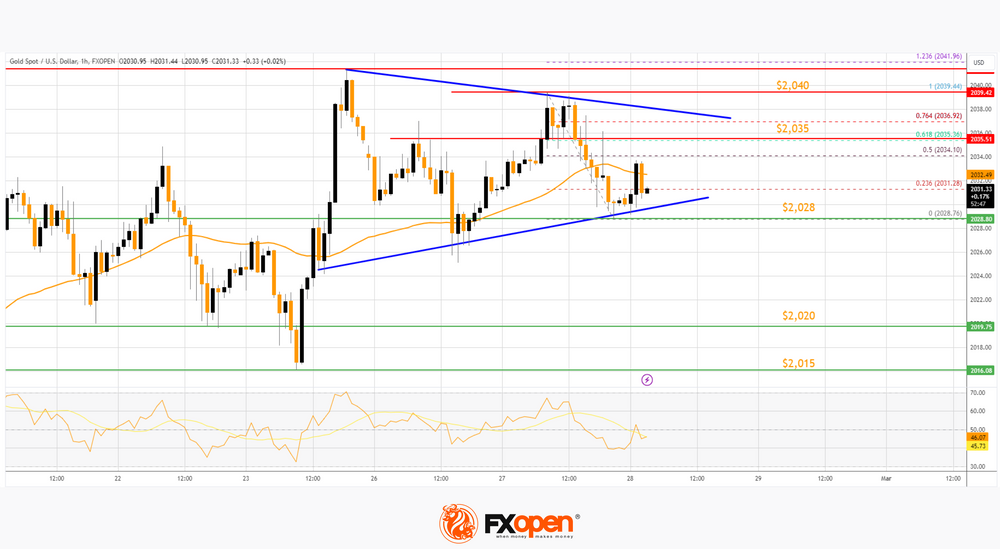

Market Analysis: Gold Price and Crude Oil Price Eye More Upsides

Gold price started a decent increase above the $2,028 resistance level. Crude oil prices are gaining bullish momentum and might rise toward $80.00.

Important Takeaways for Gold and Oil Prices Analysis Today

· Gold price started a decent increase from the $2,015 zone against the US Dollar.· A key contracting triangle is forming with support near $2,028 on the hourly chart of gold at FXOpen.

· Crude oil prices rallied above the $76.55 and $77.00 resistance levels.

· There is a key bullish trend line forming with support at $77.80 on the hourly chart of XTI/USD at FXOpen.

Gold Price Technical Analysis

On the hourly chart of Gold at FXOpen, the price found support near the $2,015 zone. The price formed a base and started a fresh increase above the $2,020 level.There was a decent move above the 50-hour simple moving average and $2,028. The bulls pushed the price above the $2,035 resistance zone. Finally, the bears appeared near $2,040, A high was formed near $2,039.44 and the price is now consolidating gains.

The recent low was formed at $2,028 and the price is now consolidating near the 23.6% Fib retracement level of the downward move from the $2,039 swing high to the $2,028 low.

The RSI is still stable near 40 and the price could aim for more gains. Immediate resistance is near the $2,035 level. It is close to the 61.8% Fib retracement level of the downward move from the $2,039 swing high to the $2,028 low.

The next major resistance is near the $2,040 level. An upside break above the $2,040 resistance could send Gold price toward $2,050. Any more gains may perhaps set the pace for an increase toward the $2,065 level.

Initial support on the downside is near the $2,028 zone. There is also a key contracting triangle forming with support near $2,028. If there is a downside break below the $2,028 support, the price might decline further. In the stated case, the price might drop toward the $2,015 support.

Oil Price Technical Analysis

On the hourly chart of WTI Crude Oil at FXOpen, the price started a major rally against the US Dollar. The price gained bullish momentum after it broke the $77.00 resistance.VIEW FULL ANALYSIS VISIT - FXOpen Blog...

Disclaimer: This article represents the opinion of the Companies operating under the FXOpen brand only (excluding FXOpen EU). It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

-

AAPL Share Price Rises Nearly 1% after Scrapping Electric Vehicle Plans

In 2021, the release of an electric car from Apple was expected in 2025, in 2022, the deadline was shifted to 2026. As it became known yesterday from Bloomberg and WSJ, Apple decided to completely abandon the project.

Causes for this decision:

→ the electric vehicle market turned out to be not so turbulent;

→ production and technological difficulties;

→ the strong development of electric vehicle construction in China may also have played a role.Some employees will be fired, others will be transferred to a more promising department related to developments in the field of AI. Despite the fact that the ambitious project, which lasted about 10 years, failed, the price of AAPL shares rose by almost 1% yesterday as a result of trading — perhaps investors positively assessed the reorientation from electric vehicles to a more promising direction related to AI.

The AAPL stock chart shows that the level of USD 180 per share acts as support; several rebounds from it have already been formed in 2024. And the news about the abandonment of plans to produce electric vehicles caused the last of them. However, how reasonable is it to buy AAPL shares in such a situation?

Issues for bulls may include:

→ the fact that the price of AAPL is significantly weaker than stock indices, which are rewriting historical peaks thanks to NVDA, MSFT and other leaders;

→ the results of reorientation from electric vehicles to AI are a long-term and uncertain prospect;

→ from the point of view of technical analysis of AAPL stock, a downward trend appears on the chart (shown in red). Its upper border is a potential resistance line. And if there is a bearish breakout of the important USD 180 support, it could further resist the bulls' attempts to restore the AAPL share price.Also causing negativity is that:

→ the price is fixed below the black trend line;

→ MACD is in bearish territory.VIEW FULL ANALYSIS VISIT - FXOpen Blog...

Disclaimer: This article represents the opinion of the Companies operating under the FXOpen brand only (excluding FXOpen EU). It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.